Yacht Welfare – Fiscal Representative | Charter Tax

Fiscal representative vat compliance charter tax, vat rules and rates in the eu.

What is VAT?

Value Added Tax (VAT) is a consumption tax that is applied to nearly all goods and services that are bought and sold for use or consumption inside of the European Union (EU). The EU has standard rules on VAT, but these rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer. This includes from the beginning to the end of a production process, e.g. buying components, transport, assembly, provisions, packaging, insurance and shipping to the final consumer.

When is VAT charged?

For EU-based companies, VAT is chargeable on most sales and purchases of goods within the EU. In such cases, VAT is charged and due in the EU country where the goods are consumed by the final consumer. Likewise, VAT is charged on services at the time they are carried out in each EU country.

Is VAT charged on export of goods to non-EU countries?

No. VAT is not charged on exports of goods to countries outside the EU. In these cases, VAT is charged and due in the country of import and you do not need to declare any VAT as an exporter. However, when exporting goods, you will need to provide documentation as proof that the goods were transported outside the EU. Such proof could be provided by presenting a copy of an invoice, a transportation document or an import customs record to your tax authorities. You will need to provide this proof to be able to fully deduct any receivable VAT that you have paid in a previous related transaction leading up to the export. Insufficient documentation may mean you won’t have the right to a VAT reimbursement when exporting goods.

Is VAT charged on Charters?

Yes, it is. The charter of yachts is a commercial activity subject to VAT. This VAT is due in the Member State where the commercial activity has its fiscal relevance (e.g. the Member State where the charter depart from).

What about Italy?

The Italian Tax Revenue Office (Agenzia Delle Entrate) has decreed to implement VAT on charters year ago. Therefore, the charter of yachts within Italian Waters that are registered as Commercial Vessels and are used exclusively on “Charter” (Short-Term Hiring of a Yacht, not exceeding 90 days) cannot legally be exempt from the VAT.

How to comply?

In Italy, in order to comply with the legislation, companies owning yachts (that need to execute charter activity with fiscal relevance into the Italian territory) must be registered for VAT directly or appoint a Fiscal Representative to manage the tax on their behalf, as per DPR 633/72 Art.17. In both cases the opening of a Italian VAT position is required. The appointment of a VAT / Fiscal Representative or the direct identification became obligatory starting by year 2011 as per Circular 43/E – 29th September 2011. The Fiscal Representative activity requires several important duties and formalities which YACHT WELFARE has the highest requisites to perform systematically. YACHT WELFARE is qualified to complete all the necessary tax formalities and fiscal operations.

YACHT WELFARE is suitably structured to fulfil the VAT tasks on your behalf and to shoulder every responsibility to comply with the Italian law. If you need more info and/or to appoint YACHT WELFARE as your Fiscal Representative for Italy please contact us to [email protected] . By sending us an email to [email protected] you will be able to obtain a copy of the Contract Agreement and the required Annexes to obtain your IT VAT Code and comply with the Italian laws and regulations.

I contenuti del presente sito sono coperti e tutelati dalle norme sulla proprietà intellettuale. Ne è vietata la copia o la riproduzione anche parziale se non autorizzata. Ogni violazione sarà perseguita a sensi di legge.

Changes to Italian Yacht Charter Tax Come into Force

Update (8 October 2020): The VAT increase on Superyacht charters in Italy has been delayed until November 2020. See our new article for up-to-date details.

As of 16 th June 2020, the Italian Tax Authority has imposed new changes to VAT on superyacht charters. The new changes mean that yacht charters in Italy will be subject to the country’s 22% VAT (Value Added Tax) rate, and that flat-rate reductions will no longer apply.

Until now, yacht charters commencing in Italy (as well as other European countries) were eligible for a reduction if they entered into international or non-EU waters (12 nautical miles off the coast) during the charter period. In Italy these lump sum tax bands were based on the yacht’s size and type so, for example, the charter contract of a motor yacht over 24 meters was subjected to a rate of 30% of the standard VAT (so 6.6%). In France, a simpler 50% reduction of the taxable base of the charter contract was granted to yachts cruising into international waters for any length of time.

The new laws, which were put in motion in December 2019, now mean that only time spent in international waters is eligible for the tax reduction, whilst the rest of the charter is subject to full VAT rates.

Other Countries to Follow Suit

The European Commission put these changes forward, asking countries such as Italy, France, Cyprus and Malta to change the long-standing simplified VAT structures, and while Italy is just the first, the others are expected to follow suit soon. France announced a delay to the VAT changes in April in light of COVID-19 and its effect on the charter industry, but it’s a matter of watch this space as to how long that lasts.

How is the new yacht charter tax calculated?

Instead of a flat rate tax reduction for yachts which entered into international or non-EU waters during their charter, the new VAT rates only account for time spent in those waters. Therefore, if a yacht spent 12 hours in international waters out of a 7 day charter, 6.5 days would be taxed at Italy’s standard rate of 22%, and the 12 hours would not.

In order to comply with the new regulations, yachts will need to maintain a record of time spent in international waters including documentation such as travel cartography data, a navigational log book kept by the captain, digital photographs showing the yacht’s location throughout the charter, or documentation showing the yacht moored outside EU territory. These must be kept for a minimum of six years.

The new tax changes are now in place, and for those chartering in Italy full VAT will be applied to both new contracts and those which have been signed even prior to April 1st. However, while it’s important to be aware of the changes, your broker will be able to explain precisely how this will affect the final price you pay for your charter based on the itinerary you choose. With Europe now open for superyacht charters in 2020 and lots of beautiful yachts poised to whisk you off on a socially distanced luxury holiday (plus throw in some reassuring new charter contracts), there’s never been a safer or better time to plan a family yacht charter.

For more information, get in touch with our team of expert brokers who have all the latest information on travel, tax, contracts and of course the best destinations and yachts for your charter.

Previous Post

Share this page

- All Superyachts for Sale

- Motor Superyachts

- Sailing Superyachts

- Buying A Superyacht

- Selling a Superyacht

- Buying a Yacht FAQs

- Selling a Yacht FAQs

- Why choose us?

- Building a Custom Superyacht

- Build a Semi-Custom Superyacht

- Yacht Management

- Yacht Marketing

- All Superyachts for Charter

- How To Charter A Yacht FAQS

- Concierge Services

- Design Your Perfect Itinerary

- Mediterranean

- Indian Ocean & Asia

- South Pacific

- The Rest of the World

- Where Can I Travel?

- Summer Experiences

- Winter Experiences

- Wellness and Fitness

- Parties and Event Planning

- Adventures and Experiential Travels

- Yacht and Boat Shows

- Sporting Events

- Corporate Events

- Social & Luxury Events

- Sailing Regattas

- Charter Itinerary Builder

- Distance Calculator

- In the press

- Superyacht Charter Fast Facts

- Superyacht Sales Fast Facts

- Meet Our Team

- Our Offices

- Current Role

Privacy Overview

The Italian VAT regime on the leasing and chartering of pleasure vessels 13 May 2022

The italian government (the “government”) has made several changes in recent years to the territorial scope of vat rules on the supply of services relating to leasing and chartering of yachts (the “ vat territoriality rules ”), in order to make them user-friendly and compliant with eu law..

"The new amendments have been acted to address objections from the European Commission which had commenced legal proceedings claiming that Italy had been incorrectly applying VAT Territoriality Rules."

Overview and background

The legislative changes to the VAT Rules are as follows:

- Article 1, paragraphs 725 and 726, of Law no. 160/2019 (the “2020 Budget Law”);

- Article 48, paragraph 7, of Decree-Law no. 76/2020 (the “Simplification Decree”); and

- Law no. 178/2021 (the “Budget Law 2021”).

These changes have primarily been enacted to address objections from the European Commission (the “Commission”), which had commenced legal proceedings claiming that Italy had been incorrectly applying the territorial scope criteria of Directive 2006/112/EC (the “VAT Directive”). The VAT Directive states that, for short-term hired transport, the place of supply is the place where the transport is actually used by the customer, whereas Italy had been using a flat-rate criteria (based on percentages of presumed use according to the length and propulsion of a yacht) to assess whether a leased or chartered yacht fell within the territorial scope of Italian VAT. As a result, the Commission alleged that Italy was failing to comply with Article 56 (which establishes the deemed place of supply and the definition of “short-term hiring”) and Article 59 (which establishes the deemed place of supply for a number of activities) of the VAT Directive.

The Budget Law 2020

From 1 April 2020, the 2020 Budget Law replaced the flat-rate calculation method (described above) with a criteria similar to the VAT Directive and based on where the chartered or leased yacht was actually being used by the customer.

The Simplification Decree

The Simplification Decree postponed the application of the provisions in the 2020 Budget Law to transactions carried out from 1 November 2020.

The Simplification Decree also extended the scope of application of the provisions in the 2020 Budget Law – which had originally applied only to B2B short-term services – to B2C long-term services (i.e. services lasting more than 90 days).

"The Italian Revenue Agency has provided clarity on how to demonstrate that a leased or chartered yacht’s place of actual use by the customer is outside the EU."

Implementation

The Italian Revenue Agency has provided, by Measure no. 341339 of 29 October 2020, clarity on how to demonstrate that a leased or chartered yacht’s place of actual use by the customer is outside the EU.

For short-term and long-term services, at least one of the following pieces of evidence must be provided:

i. data and information obtained from the satellite navigation or transponder systems (e.g. an Automatic Identification System);

ii. digital photographs of the yacht’s point for each week of navigation as detected by any device and taken at a frequency of at least two per week of navigation;

iii. documentation (e.g. invoices, contracts, fiscal receipts and related means of payment) proving that the yacht is moored in ports located outside the EU; or

iv. documentation (e.g. invoices, contracts, fiscal receipts and related means of payment) proving that goods and/or services were purchased from commercial establishments located outside the EU for use outside the EU.

For long-term services only, evidence of actual use outside the EU is provided through the following:

i. the leasing, financial or charter contract, or a similar document; and

ii. the hard copy of the digital data from the yacht’s navigation journal, the yacht’s official logbook or the yacht’s fully certified logbook.

The Budget Law 2021

Key contacts.

Alfredo Guacci Esposito

Senior Associate Milan

Michele Autuori

Partner Rome

"The Budget Law 2021 established that actual use of a pleasure boat outside the EU must be supported by evidence and a declaration made by the user of the boat."

The Budget Law 2021 further addressed the subject of the VAT Rules by establishing that actual use of a pleasure boat outside the EU must be supported by evidence and a declaration made by the user of the boat .

To this end, as of 14 August 2021, the Revenue Agency has introduced a requirement for a declaration issued by a purchaser that allows a supplier to issue invoices for payment on account with partial exclusion of tax (the “preliminary declaration”). The preliminary declaration is only required if advance payment invoices are issued and the supplier has no certain references regarding the actual use of the yacht in EU member state territorial waters.

At the end of each calendar year, and by 31 January of the following year, users must submit a new declaration (the “final declaration”). In the final declaration, the user certifies the actual use of the yacht in EU territorial waters, on the basis of which the supplier shall, if necessary, issue a variation note (pursuant to Article 26 of Presidential Decree no. 633/1972), without application of interest and penalties.

The legislative changes discussed above have been welcomed in Italy and form part of a broader international drive to standardise and clarify global tax regimes to aid transparency and anti-avoidance measures.

DOWNLOAD PDF

- Italian VAT

Related insights

M&a basic principles– part i, commercial disputes weekly – issue 207, the italian non-domiciled tax regime, follow us on.

- X (Twitter)

- Destinations

What is the VAT in Italy when you rent a yacht?

When we plan a sailing holiday in Italy we have to get informed about the VAT and the rules that manage it. Below all the information you have to know before your yacht charter, in order to enjoy it relaxing, without worries.

The Yacht charter VAT is a form of consumption tax.

Points of view about the VAT in Italy when you rent a yacht

– For the seller, the VAT is a tax only on the value added to a product, material or service, from an accounting point of view, by this stage of its manufacture or distribution. – The manufacturer remits to the government the difference between these two amounts and retains the rest for themselves to offset the taxes previously paid on the inputs.

The value added to a product by or with a business is the sale price charged to its customer, minus the cost of materials and other taxable inputs. The VAT is like a sales tax in that ultimately only the end consumer is taxed. It differs from the sales tax in that with the sales tax, the tax is collected and remitted to the government only once, at the point of purchase by the end consumer. With the VAT, on the other hand, collections, remittances to the government, and credits for taxes that are already paid occur each time a business in the supply chain purchases products.

What we really have to know about VAT when you charter a yacht in Italian waters?

Compliance with VAT is easier than it looks: a yacht is just a means of transport which can be exploited for the purposes of providing service, so it can be exposed to the Value Added Tax.

Why the value-added tax changes if we navigate in Italian waters and if we not?

The standard VAT rate for chartering a yacht in Italy (Article. 40, co. 1-ter of Legislative Decree 98/2011 has introduced the following important change: With effect from 1 October 2013, the rate of VAT of 21 percent is restated to the extent of 22 percent) is the 22%. This value is applied only to charter fees if the yacht cruises only in Italian/EU territorial waters. If a yacht cruises both within and outside EU waters, VAT is due only on the charter fee in proportion to how much time is spent in EU waters compared to the entire charter period.

VAT – Clarifications regarding Territoriality and Taxation of Operations related to the Pleasure Boat Industry:

1. Use of recreational craft within the territorial waters Community:

In the case of provision of recreational craft in the State, in order to determine the period of use of the same within the Community territorial waters, wonders whether the alleged use of flat rates within those waters provided by circular no. 49 of 7 June 2002 as well as clarifications contained in Circular. 38 of 22 July 2009, are still applicable both while lease, rental and similar recreational craft too. As in the case of a short-term lease, also financial, rental and long-term.

2. Short-term rental and availability of the boat in the territory of another State Member of the European Community:

In case of short-term rental of a boat in the territory of another State Member of the UE, are these performances excluded from Italian VAT? The performances of a short-term lease of means of transport (financial, rental and similar) are considered territorially relevant in Italy. Such benefits shall be regarded as within the state when the means of transport “are made available to the recipient in the territory of that State and if they are used within the territory of the Community” and also “when the means of transport are made available to the recipient outside the territory of the Community and are used in the State”. The provision of short-term rental and availability of the boat in the territory of another Member State of the Community is not mentioned among those that the rule qualifies as territorially relevant in Italy.

However, since it is not possible to determine exactly how much time will be spent within and outside EU waters prior to the charter, Circular no.49/E of 07.06.2002 issued states that the time spent outside Italian/EU waters may be quantified as a ‘package’.

Javascript is disabled on your browser. Please enable it in order to use this form.

FIND YOUR BOAT

Your form has been submitted.

Thank you for your request. Our team will answer to you within 24 hours. I you have an urgent request then you can also call us on +39-3343600997.

We faced problems while connecting to the server or receiving data from the server. Please wait for a few seconds and try again.

If the problem persists, then check your internet connectivity. If all other sites open fine, then please contact the administrator of this website with the following information.

TextStatus: undefined HTTP Error: undefined

Some error has occured.

Share this Post

MY JOURNEY 102′ (31m) Sanlorenzo FILL THE GAP 15 – 22 June, Dubrovnik-Split

My grande amore, benetti 145 offers 25% discount for any weekly charter from 1-14 june 2024 in greece, my entrepreneur – usd 20,000 discount for next 2 bookings in july or august, 2024 in the bahamas, 36.9m/121’1″ couach yacht for charter arion – last summer 2024 availabilities.

Italy and France VAT regulations on 2023

- Destinations

France and Italy introduce new VAT Rules and there will be no reduced VAT.

There were two major changes to the French VAT laws that took effect on March 31st, 2020.

The first change was that the lump sum reduction was canceled, and the second change was that all yachts became liable for the full rate of 20% from March 31st, 2020.

As of 2023, the VAT laws in France have not changed and the full rate of 20% for yachts still applies.

In December 2019, changes were made to the Italian VAT laws that took effect on April 1st, 2020.

Prior to these changes, yachts larger than 24m were eligible for a reduction in VAT from 22% to 6.6%.

However, after these changes took effect, this reduced VAT rate was no longer available for all Italian charters , whether the charter began in Italy or in another EU territory and entered the region later.

What is in it for you:

Get in touch with our expert consultants to receive best rates and get ready for your one of the life time experience.

- Vacation tips

POPULAR ARTICLES

How to charter yacht like a pro? (2023 Edition)

Social Distanced Yacht Charter

6 reasons to book your first yacht vacation with Rendezvous Yachts

How Corona Virus Restrictions in Italy will effect yachting industry in 2022?

Popular tags.

- yacht charter

- yacht rental

- vacation on a yacht

- yacht chartering ideas

- Yacht rental

- #abudhabigrandprix

- #formula1 #Formulaonegrandprix

- bahamas charter

- Bahamas yachting regulations

- bahamas yachting tips

- best restaurants of Croatia

- Charter destination

- March 2023 (1)

- February 2023 (2)

- January 2023 (2)

- December 2022 (2)

- October 2022 (1)

- September 2022 (2)

- July 2022 (1)

- June 2022 (3)

- May 2022 (1)

- March 2022 (1)

- December 2021 (1)

- May 2021 (1)

- March 2021 (1)

Rendez-Vous Yachts is made of a professional Captains who spent decades of their life at sea and experienced on exclusive yacht chartering. At Rendez-Vous Yachts, we always strive for complete customer satisfaction.

DESTINATIONS CHARTER YACHTS SERVICES THE TEAM EVENTS BLOG CONTACT

Copyright © 2024 Rendez Vous Yachts LLC. All Rights Reserved. | GDPR Information | Site: İkipixel

New (effective) VAT rate on chartering activities in Italy

Italy cancels (effective) reduced vat rates on boat chartering with their itinerary in international waters..

Italian tax authorities will introduce new means to calculate the time spent in non-EU waters by boats starting a short term-leasing service in Italy. These changes will apply as from 1 April 2020. In practice, and until the new calculation methods are published, it is recommended to charge 22% standard VAT rate on all charters starting in Italy after April 2020.

Use and enjoyment in yacht chartering services

Under the current rules on place of supply of services, Member States are allowed to deviate the place of supply according to the place where the service was effectively used and enjoyed. This rule is called ´used and enjoyment provision´. Such provision is an exception from the general rules on place of supply of services (either B2B or exceptions to the B2B). In the boat chartering industry, the place of supply rule says that VAT should be charged on the full value of the charter in the country where the passengers accessed the boat. However, the use an enjoyment provision allows for an effective reduced rate if the boat spent time in non-EU waters. The calculation of the time spent on non-EU waters is being revised in Italy by 1 April 2020.

France has a similar system in place, although in France VAT is normally calculated at 50% (effective rate of 10% ) without complex calculations like those applicable in Italy. Other countries like Spain do not apply the Use an enjoyment provision for this service, so that 21% VAT is due on the full value of the charter irrespective of the itinerary of the boat.

How can we help you?

Marosa has extensive VAT experience in the boat chartering industry. We handle VAT registrations , VAT advisory , fiscal representation and VAT return submission for chartering businesses across Europe. Contact us to receive more information on how we can help you recovering historic VAT and staying up to date with all your compliance obligations.

Related VAT news

Ubo annual obligation in portugal.

Portuguese VAT-registered taxpayers must submit an annual confirmation of the information in the UBO registry in Portugal.

United Kingdom

Uk and italy reach reciprocity agreement for vat refunds.

UK and Italy reach a reciprocity agreement for VAT refund purposes via 13th Directive. UK businesses can now claim the VAT incurred in Italy even though not being VAT-registered.

New E-Delivery Address Requirement in Poland

New E-Delivery Address requirement for established businesses in Poland replacing the paper correspondence. The requirement has recently postponed.

We use cookies to offer an improved online experience. More information

Home > VAT Guide by sector > Yachts, charters & VAT

Yachts, charters & VAT

Understand intra-community vat regulations.

How are charters from one or more EU Member State taxed? What are the VAT rules for charters ? When should you appoint a fiscal representative or tax advisor?

A summary by the experts

Charters lasting less than 90 days departing from an EU Member State are subject to VAT at the place where the yacht is made available , on the date the contract starts, whether or not the passengers are on board.

Some Member States have opted, as authorised by the European VAT Directive, not to tax charter fees for the part of the hire which corresponds to the segment of the navigation carried out outside of EU waters. This is the case in France and Italy. The methods of calculating the tax basis, and therefore the non-taxable part of the fees, differ from country to country. In order to benefit from these provisions, yachts must provide evidence. What is required varies according to national regulations (logbooks, AIS tracking, etc.)

Charters lasting less than 90 days departing from a third country and passing through the territorial waters of certain EU Member States are subject to VAT on the part of the journey located within the EU waters of countries exercising this option.

The methods of calculation and proof also vary from one State to another.

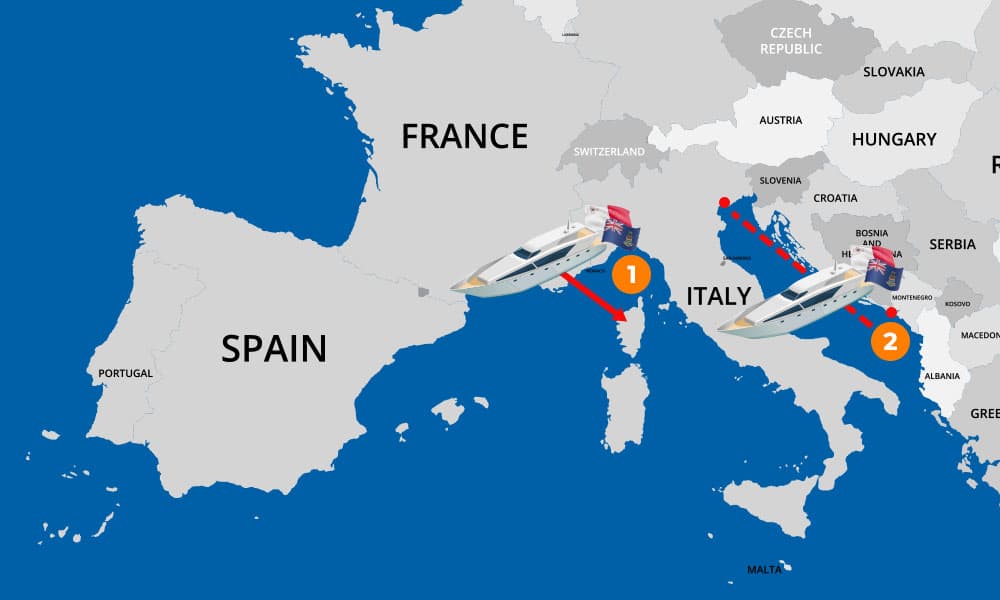

Examples of charters in the Mediterranean

Charters from a European Union country (France) using international waters

You are a shipping company based in Malta . You organise charters from France . One of your clients is planning a stopover in Corsica . This route uses international waters (more than 12 nautical miles).

- Until 31st October 2020 , charter fees were taxable in proportion to the use of the vessel in EU territorial waters. As this share became difficult to determine, the ship hiring client could apply a flat-rate reduction of 50% on the total amount of the fee, regardless of the nature of the vessel concerned.

- As of 1st November 2020 , hire fees are in principle fully taxable in France. However, the part of the fee corresponding to the proportion of the actual use or operation of the vessel outside the territorial waters of the EU is exempt from VAT under Article 59a of Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax. It is the taxpayer’s responsibility to assess the part of the fee that is exempt and this can be subject to inspection by the authorities. The taxpayer may corroborate the assessment by any means.

You need a tax representative to register for VAT and file your VAT returns in France with the required documents.

Charters from outside the European Union (Montenegro) using Community waters (Italy)

You are a shipowner based in Malta and are organising a charter from Montenegro. One of your clients is planning to sail in Italian waters .

As Italy has opted to tax the part of the charter located in Italy (based on the time spent in Italian waters), you will have to pay Italian VAT on this part of the charter.

You need a tax representative to register for VAT and file VAT returns in Italy with the required documents.

These examples are given to clarify VAT mechanisms and explain your obligations. It is worth checking the regulations for your particular transactions in line with the law, doctrine and practices in each of the EU member States. Contact us for more information!

Why do you need a fiscal representative?

A tax advisor or fiscal representative can register for VAT on your behalf and help you fulfil your obligations in each of your charter’s departure countries.

European regulatory references

Hiring means of transport.

1. The place of short-term hiring of a means of transport shall be the place where the means of transport is actually put at the disposal of the customer.

2. The place of hiring, other than short-term hiring, of a means of transport to a non-taxable person shall be the place where the customer is established, has his permanent address or usually resides.

However, the place of hiring a pleasure boat to a non-taxable person, other than short-term hiring, shall be the place where the pleasure boat is actually put at the disposal of the customer, where this service is actually provided by the supplier from his place of business or a fixed establishment situated in that place.

3. For the purposes of paragraphs 1 and 2, ‘short-term’ shall mean the continuous possession or use of the means of transport throughout a period of not more than thirty days and, in the case of vessels, not more than 90 days.

Source: Article 56 of the Directive 2006/112/EC

Prevention of double taxation or non-taxation

In order to prevent double taxation, non-taxation or distortion of competition, Member States may, with regard to services the place of supply of which is governed by Articles 44, 45, 56, 58 and 59:

(a) consider the place of supply of any or all of those services, if situated within their territory, as being situated outside the Community if the effective use and enjoyment of the services takes place outside the Community;

(b) consider the place of supply of any or all of those services, if situated outside the Community, as being situated within their territory if the effective use and enjoyment of the services takes place within their territory.

However, this Article shall not apply to electronically supplied services where those services are supplied to non-taxable persons established outside the Community.

Source: Article 59a of the Directive 2006/112/EC

Registering for VAT

1. Member States shall take the measures necessary to ensure that the following persons are identified by means of an individual number:

(a) every taxable person, with the exception of those referred to in Article 9(2), who within their respective territory carries out supplies of goods or services in respect of which VAT is deductible, other than supplies of goods or services in respect of which VAT is payable solely by the customer or the person for whom the goods or services are intended, in accordance with Articles 194 to 197 and Article 199;

(b) every taxable person, or non-taxable legal person, who makes intra-Community acquisitions of goods subject to VAT pursuant to Article 2(1)(b) and every taxable person, or non-taxable legal person, who exercises the option under Article 3(3) of making their intra-Community acquisitions subject to VAT;

(c) every taxable person who, within their respective territory, makes intra-Community acquisitions of goods for the purposes of transactions which relate to the activities referred to in the second subparagraph of Article 9(1) and which are carried out outside that territory.

(d) every taxable person who within their respective territory receives services for which he is liable to pay VAT pursuant to Article 196;

(e) any taxable person who is established within their respective territories and who, within the territory of another Member State, supplies services for which only the customer is liable to pay VAT pursuant to Article 196.

2. Member States need not identify certain taxable persons who carry out transactions on an occasional basis, as referred to in Article 12.

Source – Article 214 of the Directive 2006/112/EC

Fiscal representation

A simple, reliable and efficient solution for all your VAT obligations in all EU countries and some non-EU countries.

Contact an expert

Easytax International assists you and takes care of all your VAT and customs operations in the complex yachting sector.

For all European Union countries and some third countries.

For all European Union countries and some third countries. For all your VAT, Intrastat & ESL obligations, and your VAT recovery requests.

Get the latest news on VAT regulations in Europe directly in your mailbox.

We respect your personal data

Easytax acts as a VAT agent and fiscal representative in the 27 European Union countries and some third countries for companies with international VAT issues. More >

VAT Services

- Fiscal representation across Europe

- VAT Online Simulator

- Foreign VAT recovery

- OSS, IOSS: outsource your VAT One-Stop-Shop’s management

- A Guide to intra-Community VAT

- VAT Guide by Industry

© Easytax 2021 – Legal Info, T&C – Cookies – Personal Data

- Yacht Sales

- Destinations

- Monaco Grand Prix

- About Ahoy Club

- Meet The Team

your guide to yacht chartering VAT

Below is a guide to the tax rate applied in some of our key yachting destinations. *Please note this information provided is intended for general informational purposes only and should not be considered as professional tax advice.

Make an Enquiry

INSIGHT: Yacht and Marina Services—Tax Implications

By Rajeev Agarwal

In order to understand the relevant context for an analysis of tax for yachting and marina services in the Mediterranean region, it is helpful to provide a brief explanation of the nature of this business.

Services offered by marinas include wet storage and anchorage, boat servicing, repairs and chandlery, accommodation and recreational amenities. The provision of charter services for yachts is another major revenue center for many marinas, as many global yacht charter companies use the region for staging yachts for bareboat charters.

In terms of services for boats, many marinas have installed fuel docks, pump-out and haul-out equipment, and also provide an extensive range of repairs, including electrical services, mechanical and diesel, scraping and painting, sail making and repairs, upholstery, and woodworking.

Analysis of Value-added Tax

Council Directive 2006/112/EC on the common system of value-added tax (the Recast Sixth VAT Directive) was implemented in France. A taxable person for value-added tax (VAT) purposes is any person (individual or legal entity) who independently carries on an economic activity in France, regardless of his legal status, his position with regard to other taxes and the nature or form of his activities. “France” refers to metropolitan France, Corsica and Monaco.

The following is an analysis of the VAT implications for yacht services:

- Yacht charter services—charter services are subject to VAT of 20%. VAT is due in the place of supply, the place where the yacht is made available to the charterer. If the charter started in France, VAT would be applicable in France. There is an argument within the superyacht industry in France that charter hire charges for yachts which include international voyages could be subject to a VAT rate of 10% instead of 20%. In this regard, charter companies that make international voyages could opt for the prorate, if the time spent inside and outside of French internal waters can be demonstrated, i.e. a yacht exits the 12 nautical mile limit from the coastline and enters international waters during the charter. A yacht operator should also consider that 70% of trips must be international trips in a year. There is a mandatory requirement to maintain documents to claim concessional VAT—charter agreement, log book and other supporting documents. The charterer will be required to produce or submit these for verification during a tax audit.

- Boat servicing, repairs and chandlery services—the place of supply of services rendered to a non-taxable person by an intermediary acting in the name and on behalf of another person is in France provided that the place of supply of the underlying transaction is located in France and is subject to VAT of 20%.

- Fuel—Article 265 of the French Tax Code was modified on January 1, 2014 to read that only vessels used commercially by their end-users can benefit from excise duty exemption. Hence, yachts chartered for recreational purposes are excluded from the excise exemption on fuel supplies, as their end users do not use them for commercial purposes. As such, any fuel (bunker) purchased in France will be subject to excise duty of 50% of cost of fuel.

- Anchorage tax of 20 euros ($22.50) per day per linear meter.

- Wet or dry storage services are treated as supplies provided in France, subject to the standard rate of VAT of 20%.

It is necessary to appoint a fiscal agent/representative in France and/or Monaco depending upon where the charters start and to obtain a French/Monaco VAT number.

VAT is applicable on supplies made during the exercise of a trade or business, or an entrepreneurial, artistic or professional activity. Under Article 4(5) of the relevant Italian VAT Law, pure holding companies are excluded from the definition of taxable persons if their activities are limited to owning ships for the private use of shareholders or their families, free of charge or for consideration below normal value.

A supply of services is defined under Article 3 of the Italian VAT Law as the performance for consideration of services for procurement, transportation, shipping, brokerage, warehousing and other services under an obligation to do, refrain from doing, or permit something. The place of supply is Italy if:

- passenger transport in Italy is in proportion to the total distance traveled in Italy;

- short-term vehicle leases in Italy if the vehicles are made available to the client, for vessels up to 90 days.

Short-term hiring out of a means of transport, both to businesses and private customers, derogates from the general place of supply rules. According to Article 7(1)(e) of the VAT Act, the service is taxed in Italy if the means of transport are put at disposal in Italy, provided that they are used in the territory of the EU, or, if the means of transport are put at disposal outside the territory of the EU, when they are used within Italian territory. “Short-term” supplies means over a period of time not exceeding 30 days: for boats, this term is extended to 90 days. So a foreign flagged yacht can qualify for short-term hiring, if it is hired for 90 days for recreational or pleasure trips within Italian water.

Article 7(1)(e) of the VAT Act provides a special VAT regime concerning the supply (i.e. long-term hiring) of pleasure boats—such type of supply is deemed to be carried out in Italy provided that:

- the pleasure boat is made available in Italy by a supplier that is a taxable person established in Italy, and the pleasure boat is used within the territory of the EU;

- the pleasure boat is made available outside the territory of the EU by a supplier established in a non-EU member state, but the pleasure boat is used in Italy;

- the pleasure boat is made available in a country different from the country where the supplier is established, but the principal is established in Italy and the pleasure boat is used within the territory of the EU; or

- the pleasure boat is made available in a country different from the country where the supplier is established, and the principal is established outside the territory of the EU, but the pleasure boat is used in Italy.

Such services are deemed to be VAT relevant in Italy if the ships are used in Italy. The leasing or hiring of movable goods, including means of transport, is a supply of services.

- Yacht charter hire charges—since 2012, all charters starting in Italian waters are subject to Italian VAT of 22%. Nevertheless, according to Circulars and related rulings this VAT rate is reduced depending on the size of the vessel (based on a deemed use outside of EU waters, on the same principles as VAT applicable on Italian leasing schemes). The VAT rate applicable to charter yachts over 24 meters starting their charter in Italy and cruising in and outside of Italian waters is reduced to 6.6%. There are documentation requirements to prove that a cruise is in international waters—the charter agreement, log book, etc.

Italy has implemented the principle of use and enjoyment (EC Dir 2006/112 art 59b). In contrast to other EU countries, if a charter starts outside the EU (e.g., Montenegro, Turkey) and then enters Italian waters, VAT at the reduced rate of 6.6% (or higher for yachts below 24 meters) will apply only to the portion of the charter taking place in Italy.

- Boat repair services and chandlery services—the place of supply for services performed on movable property is in Italy when they are supplied to taxable persons established in Italy. If the recipient of services is a non-taxable person established in Italy or nonresident person, the place of supply for the services performed on movable property is in Italy when those services are carried out in Italy. As such, any boat repair services are subject to VAT of 22%.

- Fuel—duty free fuel rules are similar to France: vessels used commercially by their end-users can benefit from excise duty exemption. Hence, yachts chartered for recreational purposes are excluded from the excise exemption on fuel supplies, as their end users do not use them for commercial purposes. As such, any fuel (bunker) purchased in Italy will be subject to excise duty of 50%.

The “Spanish VAT territory” comprises the Spanish mainland, the Balearic Islands, the air space corresponding to these territories and 12 nautical miles of territorial waters. Ceuta, Melilla and the Canary Islands are excluded from the geographical scope of the VAT Law. The Canary Islands, however, are part of the Spanish Customs Union.

The general rule is that the place of supply of services to a taxable person acting as such shall be the place where that person has established his business, whereas the place of supply of services to a non-taxable person shall be the place where the supplier has established his business.

- a maximum of 30 days with respect to vehicles; and

- a maximum of 90 days with respect to vessels.

In the case of a short-term hire, the place of supply is the place where the vehicle is put at the disposal of the recipient.

In the case of a long-term hire, the general rule for business-to-business services is applicable. In a business-to-consumer situation, the place of supply is where the customer is established, has his permanent address or usually resides.

However, the place of hiring a pleasure boat to a non-taxable person, other than short-term hiring, shall be the place where the pleasure boat is put at the disposal of the customer. This exception is applicable under the condition that the service is provided by the supplier from his place of business or a fixed establishment situated in the Spanish VAT territory. Boat charter hire charges are subject to VAT of 21%.

- Repair or valuation services provided to a private person are deemed to be supplied at the place where they are physically carried out. The place of supply of these services to a taxable person is the place where the customer is established. As such yacht repair and maintenance services are subject to VAT of 21%.

- Fuel or bunker for yachts is subject to VAT of 21% and additional excise duty of 12%.

Withholding Tax

Charter hire charges.

Companies that are resident in any of the offshore jurisdictions and derive income or capital gains from Spanish, French or Italian sources will not qualify for the tax benefits available to nonresidents in general or to EU residents in particular.

Expenses on services related to transactions carried on, directly or indirectly, with persons or entities resident in an offshore jurisdiction, or services paid through persons or entities resident in a tax haven, are not deductible for tax purposes (unless it can be proved that the expense is related to a transaction carried on for valid economic reasons). Withholding tax rates can go up to 33%.

In Spain and the Balearics, withholding tax has been applied since 2014 and is collected by the fiscal agent who has been appointed by the yacht owner as part of the prerequisite arrangements before any yacht can commence charter operations.

The French authorities are currently enforcing this tax when the charter brokers hold funds in a French bank account and funds are transferred to yacht-owning companies from non-tax treaty territories. The responsibility falls to the French management or charter company to pay the withholding tax to the French government; however, most charter brokers bank outside of France.

Planning Points

Tax is rarely straightforward and VAT in relation to yachts is no different. Yacht owners should be aware that each member state has a certain level of discretion as regards the interpretation, implementation, administration and enforcement of the EU legislation regarding VAT.

This can cause difficulties in interpretation and of course, different members may charge VAT differently on various types of yacht services. Yacht owners may check whether they qualify for commercial exemption rules in France or Italy and claim VAT-free supplies such as fuel for yachts. Charterers may also check if they can claim reduced VAT on charter hire for international voyages.

Transport contracts for providing transport services can also be considered as an option.

Yacht operators must maintain detailed documents such as charter agreements, service agreements, log books, invoices, customer details, etc., to claim concessional VAT for submission before the tax authorities during audits.

All yacht-owning companies established in territories that are undertaking charter activity should consider restructuring arrangements. Migration of the existing company, or establishing a new yacht-owning company in a more suitable jurisdiction that does not trigger withholding tax issues, is the preferred option.

There are several other factors to consider in the restructuring arrangements including crew employment and payroll, suitability of flag, the yacht’s “in free circulation” status, financial arrangements and the physical location of the yacht.

Marina businesses can take advantage of the benefit of accelerated depreciation or investment credit, which is deductible or adjusted against corporate tax liabilities.

A leasing agreement can be explored, under which the lessor retains ownership and receives a favorable tax treatment if certain conditions are fulfilled.

Rajeev Agarwal is Head of Global tax with Qatar Navigation QPSC. He may be contacted at: [email protected] .

Disclaimer: The content of this article is intended for general information purposes. You should always seek professional advice before acting. No responsibility is taken for any loss because of any action taken or refrained from in consequence of its contents.

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

- Inquire Now

- YACHT SEARCH

- Motor Yachts

- Sailing Yachts

- $1 – $25,000 Yachts

- $26,000 – $50,000 Yachts

- $50,000 – $100,000 Yachts

- $101,000 – $200,000 Yachts

- $200,000 – ∞ Yachts

- Turks and Caicos

- Virgin Islands

- Spain & Balearic Islands

- New England

- Tahiti & South Pacific

- More destinations

- Charter Advice

Italy Yacht Charters

Italy has long been considered one of the world’s top yachting destinations. With its welcoming culture, tantalizing food, and sweeping coastlines, there’s no better place to take your next getaway. Italy yacht charters offer an innovative way to tour the country, all from the comfort of your own private vessel.

Explore the cerulean blue waters of the Mediterranean Sea, or dock and explore the bustling cities of Rome and Venice. Home to the rich history, stunning museums, and top-of-the-line shopping, after you reserve an Italy yacht charter, you may never want to leave.

Italy Yacht Charter Highlights

- Equal parts romantic and adventurous

- Breathtaking views

- Fine dining and amazing local cuisine

- Thermal spas and hot springs

- Dramatic coastal scenery

Showing 1–4 of 131 results

282.2ft / 84m

278.1ft / 83m

239.6ft / 71m

Serenity 236

236.3ft / 70m

Area Guide: Italy Charter Destinations

You could spend months exploring all the hidden treasures that Italy has to offer. But in the interest of time, you’d better stick to the highlight reel. While you’re free to dock at different destinations during your Italy boat charter, we recommend these four popular locations:

- Amalfi Coast Home to secluded beaches, vibrant homes tucked into its jagged mountains, familiar towns, idyllic natural landscapes, fruitful terraced gardens, seaside valleys, and all the beauty a yacht charter guest could hope for, Amalfi Coast is regarded as a UNESCO World Heritage Site. Make sure to visit Positano, Capri, Sorrento, and Naples.

- Italian Riviera Equal parts glamorous and naturally beautiful, the Italian Riviera is the epitome of Italian history and class. Dotted with ancient fishing ports, inherent charm, and some of the globe’s most popular destinations, like Portofino, San Remo, and the Cinque Terre, the Italian Riviera has become an international favorite for yacht charters in the Mediterranean Sea.

- Sardinia As the second-largest island in the Mediterranean, Sardinia has one of the most beautiful coastlines in all of Europe. From near-perfect beaches and archaeological ruins to charming coastal towns and villages and world-renowned caves, Sardinia is a destination with water and land activities all yacht charter guests can enjoy.

- Sicily & Aeolian Islands Known for being a melting pot of European, African, and Asian heritage, Sicily is home to plentiful Arab castles, Greek temples, and Aragonese churches. As the largest and most unique island in the Mediterranean, it boasts architectural gems, a complex history, and interesting folklore that is sure to impress.

VAT (Value Added Tax) on Yacht Charters in Italy

As any yachter knows, when it comes to chartering in international waters, a Value Added Tax (VAT) will typically be applied. The following VAT laws pertain to private yacht charters in Italian waters:

– If a yacht only cruises through Italian/EU waters, a standard 22% VAT rate will be applied.

– If a yacht cruises both in and outside EU waters, the VAT rate is only applied to the charter for the amount of time spent in Italian waters.

Italy Yachting: When to Go

Typically, yachting season runs from mid-May through the end of September, with the height of the season being during the summer months, in July and August .

During these particular months, you will benefit from both warm climates and light winds, making this time of year ideal for boat exploration. That said, May-June and September shouldn’t be passed up as potential times to visit the area. Given that outside temperatures are still comfortable, waters are still warm enough for swimming and these months fall just outside tourist season – when destinations are most crowded – this time of year is ideal for yacht charter guests to set sail on their private charter yacht and explore the enchanting Italian coast.

Ready to explore all Italy has to offer? Enjoy pampering amenities aboard your luxurious Italian rental yacht. Here at Worldwide Boat, we’ll pair you with the vessel and crew best suiting your needs, so you can sit back, relax and enjoy a full-bodied red as you sail along the Italian coast.

Last edited by Katja Kukovic

Italy yachts by type

Italy yachts by budget.

- $1 - $25,000 Yachts

- $26,000 - $50,000 Yachts

- $50,000 - $100,000 Yachts

- $101,000 - $200,000 Yachts

- $200,000 - ∞ Yachts

193ft / 57m

Keros Island

94.8ft / 28m

Set your search criteria to find the perfect yacht

- Alaska Australia Bahamas BVI Caribbean Croatia Florida France Galapagos Greece Indonesia Italy Malaysia Maldives Mexico Mediterranean New England Norway Spain Thailand Tahiti Turkey

- Motor Yacht Catamaran Sailing Boats

- 2 4 6 8 10 12 12+

Search by yacht name

Please use a modern browser to view this website. Some elements might not work as expected when using Internet Explorer.

- Landing Page

- Luxury Yacht Vacation Types

- Corporate Yacht Charter

- Tailor Made Vacations

- Luxury Exploration Vacations

- View All 3626

- Motor Yachts

- Sailing Yachts

- Classic Yachts

- Catamaran Yachts

- Filter By Destination

- More Filters

- Latest Reviews

- Charter Special Offers

- Destination Guides

- Inspiration & Features

- Mediterranean Charter Yachts

- France Charter Yachts

- Italy Charter Yachts

- Croatia Charter Yachts

- Greece Charter Yachts

- Turkey Charter Yachts

- Bahamas Charter Yachts

- Caribbean Charter Yachts

- Australia Charter Yachts

- Thailand Charter Yachts

- Dubai Charter Yachts

- Destination News

- New To Fleet

- Charter Fleet Updates

- Special Offers

- Industry News

- Yacht Shows

- Corporate Charter

- Finding a Yacht Broker

- Charter Preferences

- Questions & Answers

- Add my yacht

- Yacht Charter Fleet

BREAKING: Flat-rate tax reductions on yacht charter in Italy still apply this summer

- Share this on Facebook

- Share this on X

- Share via Email

By Katia Damborsky 21 July 2020

The new Italian Value Added Tax (VAT) laws will not take effect until November 2020, meaning that the old flat-rate (or lump sum) reductions will still apply for yacht charter in Italy this summer 2020.

After much speculation, the Italian Tax Authorities have announced today (21 July 2020) that the new laws for applying for VAT reductions will not come into place until November 2020.

From now until that time, charters will be subject to the old scheme regardless of the signature date on the contract.

The scheme which will be in operation this summer is known as a 'lump sum' or 'flat-rate' reduction. It stands at 6.6% for yachts over 24 meters.

The delayed scheme, which will take effect in November, is based on time spent in non-EU waters. From then onwards, VAT reductions will be proven by travel cartography and AIS tracking data.

This new scheme was first introduced December 2019, when the European authorities announced major reforms for VAT reductions on Mediterranean yacht charters beginning in 2020.

The reform aims to scrap the practice of charter yachts briefly cruising into international waters in order to benefit from a VAT reduction.

While no official reason has been given for the postponement, it is possible that Italy is looking to recover its tourism season after bearing the brunt of COVID-19 during the start of summer. It's equally possible that provisons for calculating time spent in non-EU waters have not yet been made clear, so it is not yet feasible to begin implementing the new laws.

This is the second time the new reform has been postponed.

If you are interesting in a crewed yachting vacation in Italy this summer, there are plenty of beautiful spots to cruise. One of the most favoured is Italy's alluring west coast; you can browse all charter yachts on the Amalfi Coast now.

To find out more about VAT and yacht charter, or if you'd like to book a yacht, please get in touch with your preferred yacht charter broker .

yachts available to charter in italy:

88m Perini Navi 2006 / 2023

31m Custom Line 2007

82m Abeking & Rasmussen 2013 / 2018

74m CRN 2017

92m Oceanco 2014 / 2023

33m Custom Line 2020

42m Custom Line 2020

RELATED AREA GUIDES

View destinations guides, photo galleries & itineraries for areas related to this news article

- Ligurian Riviera

- Amalfi Coast

- Mediterranean

- West Mediterranean

RELATED STORIES

Previous Post

58m Feadship superyacht W redelivered after 10 month refit

Feadship's 73m superyacht PODIUM delivered

EDITOR'S PICK

Latest News

5 June 2024

4 June 2024

3 June 2024

- See All News

Yacht Reviews

- See All Reviews

Charter Yacht of the week

Join our newsletter

Useful yacht charter news, latest yachts and expert advice, sent out every fortnight.

Please enter a valid e-mail

Thanks for subscribing

Featured Luxury Yachts for Charter

This is a small selection of the global luxury yacht charter fleet, with 3626 motor yachts, sail yachts, explorer yachts and catamarans to choose from including superyachts and megayachts, the world is your oyster. Why search for your ideal yacht charter vacation anywhere else?

136m | Lurssen

from $4,353,000 p/week ♦︎

115m | Lurssen

from $2,830,000 p/week ♦︎

85m | Golden Yachts

from $980,000 p/week ♦︎

88m | Golden Yachts

from $1,197,000 p/week ♦︎

84m | Feadship

from $1,089,000 p/week ♦︎

93m | Feadship

from $1,524,000 p/week ♦︎

Maltese Falcon

88m | Perini Navi

from $490,000 p/week

122m | Lurssen

from $3,000,000 p/week

As Featured In

The YachtCharterFleet Difference

YachtCharterFleet makes it easy to find the yacht charter vacation that is right for you. We combine thousands of yacht listings with local destination information, sample itineraries and experiences to deliver the world's most comprehensive yacht charter website.

San Francisco

- Like us on Facebook

- Follow us on Twitter

- Follow us on Instagram

- Find us on LinkedIn

- Add My Yacht

- Affiliates & Partners

Popular Destinations & Events

- St Tropez Yacht Charter

- Monaco Yacht Charter

- St Barts Yacht Charter

- Greece Yacht Charter

- Mykonos Yacht Charter

- Caribbean Yacht Charter

Featured Charter Yachts

- Maltese Falcon Yacht Charter

- Wheels Yacht Charter

- Victorious Yacht Charter

- Andrea Yacht Charter

- Titania Yacht Charter

- Ahpo Yacht Charter

Receive our latest offers, trends and stories direct to your inbox.

Please enter a valid e-mail.

Thanks for subscribing.

Search for Yachts, Destinations, Events, News... everything related to Luxury Yachts for Charter.

Yachts in your shortlist

COMMENTS

VAT is also applicable for delivery and redelivery fees. Italy. The VAT rate is 22%. VAT is also applicable for delivery and redelivery fees. Spain. The VAT rate is 21% for yachts with a Spanish charter license. Greece. The VAT rate is 9.6% or 12% for yachts with a Greek charter license. Croatia. The VAT rate is 13% for a yacht with a Croatian ...

Meanwhile, if you intend to start your charter in Italy, a standard rate of 22% plus any delivery or redelivery fees will now apply, following changes to VAT laws for Italy charters from June 2020. For any itineraries that involve journeying to France, Monaco and Italy, the same rules apply: VAT is charged at the rate of the origin of the charter.

Previously, yachts larger than 24m were eligible for a reduction to their VAT- the standard 22% could be reduced to a mere 6.6%. This will no longer be the case as of April 1, and the standard 22% will be applicable to all yacht charters starting in Italy and/ or those starting outside the EU territory and then entering Italian waters.

From today, flat-rate reductions (also known as lump-sum reductions) on VAT for yachts chartering in Italy will no longer apply, regardless of the signature date on the contract. According to the EU Directive, the full 22% Italian VAT on charters will be due from now, and can only be reduced according to the time spent in non- EU waters.

Each country has its own VAT rate. Specifically, Croatia's rate is 13 percent, while Greece's rate varies from 5.2 to 13 percent. France's rate is 20 percent, Italy's rate is 22 percent, and Spain's rate is 21 percent. Additionally, there are potentially two considerations. Firstly, VAT gets paid on the charter fee, and secondly, VAT ...

They will come into effect on 1 April 2020. Previously, yachts larger than 24m were eligible for a reduction to their VAT from the standard 22% to a minor 6.6%. This reduced rate will no longer be available with all Italian charters now expected to pay the standard rate of 22%. The VAT is owed whether you begin your journey in Italian waters or ...

How to comply? In Italy, in order to comply with the legislation, companies owning yachts (that need to execute charter activity with fiscal relevance into the Italian territory) must be registered for VAT directly or appoint a Fiscal Representative to manage the tax on their behalf, as per DPR 633/72 Art.17. In both cases the opening of a Italian VAT position is required.

Update (8 October 2020): The VAT increase on Superyacht charters in Italy has been delayed until November 2020. See our new article for up-to-date details. As of 16 th June 2020, the Italian Tax Authority has imposed new changes to VAT on superyacht charters. The new changes mean that yacht charters in Italy will be subject to the country's ...

1.1. Payment of VAT on the acqui sition of a yacht in Italy. The buyer of a non commercially registered yacht built in Italy shall pay VAT in Italy at the rate of 21% unless the buyer acquires the yacht on a leasing scheme pursuant to the Italian legislation. The ordinary rate of 21% applies in both the case the buyer is an individual or a ...

The VAT Directive states that, for short-term hired transport, the place of supply is the place where the transport is actually used by the customer, whereas Italy had been using a flat-rate criteria (based on percentages of presumed use according to the length and propulsion of a yacht) to assess whether a leased or chartered yacht fell within ...

The standard VAT rate for chartering a yacht in Italy (Article. 40, co. 1-ter of Legislative Decree 98/2011 has introduced the following important change: With effect from 1 October 2013, the rate of VAT of 21 percent is restated to the extent of 22 percent) is the 22%. This value is applied only to charter fees if the yacht cruises only in ...

Following recently announced changes, any yacht charter agreement dated after 15 June 2020 is subject to new Italian VAT rules, it has today (21st July 2020) been announced that the changes to the ...

Regulations to amend the flat-rate VAT reductions applicable to yacht charters in Italy have not gone ahead as a result of the COVID-19 outbreak.. A statement by Ezio Vannucci, a Partner at Italian law firm Moores Rowland Partners has suggested that the old legislation will therefore still apply until new regulations are finalized.

As of 2023, the VAT laws in France have not changed and the full rate of 20% for yachts still applies. ITALY: In December 2019, changes were made to the Italian VAT laws that took effect on April 1st, 2020. Prior to these changes, yachts larger than 24m were eligible for a reduction in VAT from 22% to 6.6%.

Italian tax authorities will introduce new means to calculate the time spent in non-EU waters by boats starting a short term-leasing service in Italy. These changes will apply as from 1 April 2020. In practice, and until the new calculation methods are published, it is recommended to charge 22% standard VAT rate on all charters starting in ...

If a charter starts and finishes in Italy and remains within 12 miles of the Italian coast, VAT at the full rate of 21% will apply. If a charter starts and finishes in Italy but, at some point, cruises 12 miles offshore into non-Italian territorial waters, VAT at a reduced rate of 6.3% will apply. If a charter starts in another EU state before ...

All privately owned vessels used by EU residents within the EU are required to pay a Value Added Tax (VAT), which can add a hefty 20 percent to your sales price. And that's just the beginning of all the details to consider. Above: VAT on yachts can add a hefty amount to the price tag. Ed Kukla photo.

A summary by the experts. Charters lasting less than 90 days departing from an EU Member State are subject to VAT at the place where the yacht is made available, on the date the contract starts, whether or not the passengers are on board. Some Member States have opted, as authorised by the European VAT Directive, not to tax charter fees for the ...

your guide to yacht chartering VAT. Intro APA VAT Seasons Types of Yachts Chartering with Ahoy Club. ... Charter starts in Italy: Malta: 0%: No: Charter starts in Malta: Montenegro: 0%: No: Charter starts in Montenegro: Spain: 21%: Yes: Charged on number of days in Croatian waters: St Barths: 0%: No: Turkey:

The Italian authorities have confirmed that all charter contracts signed before 1 November 2020 will be charged at the previous VAT (value added tax) rate of 6.6%, rather than the soon-to-be-implemented rate of 22%- meaning you can now book a yacht charter in Italy for next year and benefit from a saving under the old scheme.

The VAT rate applicable to charter yachts over 24 meters starting their charter in Italy and cruising in and outside of Italian waters is reduced to 6.6%. There are documentation requirements to prove that a cruise is in international waters—the charter agreement, log book, etc.

The following VAT laws pertain to private yacht charters in Italian waters: - If a yacht only cruises through Italian/EU waters, a standard 22% VAT rate will be applied. - If a yacht cruises both in and outside EU waters, the VAT rate is only applied to the charter for the amount of time spent in Italian waters. Italy Yachting: When to Go

The 42-metre Benetti motor yacht New Waves has joined the market with Maël Fiolet of Camper & Nicholsons.. The Benetti Fast 140 model, constructed in GRP and designed by Stefano Righini, was delivered in Italy in 2015 and refitted in 2024.Naval architecture is by Benetti's in-house team while her interior design is by Redman Whiteley Dixon, now RWD.

The new Italian Value Added Tax (VAT) laws will not take effect until November 2020, meaning that the old flat-rate (or lump sum) reductions will still apply for yacht charter in Italy this summer 2020.

• Globally, Greece leads with 26% of yacht rental interest, followed by France and Italy (each at 17%). • In 2023, Greece retained a 31% share of charter preferences in the Mediterranean ...