- Inquire Now

- YACHT SEARCH

- Motor Yachts

- Sailing Yachts

- $1 – $25,000 Yachts

- $26,000 – $50,000 Yachts

- $50,000 – $100,000 Yachts

- $101,000 – $200,000 Yachts

- $200,000 – ∞ Yachts

- Virgin Islands

- Leeward Islands

- Turks and Caicos

- Spain & Balearic Islands

- New England

- Tahiti & South Pacific

- More destinations

- Charter Advice

Is Owning a Yacht for Charter Profitable

Is owning a yacht for charter profitable.

Yes, owning a yacht for charter can be profitable but owning a yacht will rarely “pay for itself.” Chartering your yacht presents some unique benefits that can lead to opportunities to make a profit off of your investment in a myriad of ways, including offsetting the cost of owning a yacht , selling your yacht for a profit, and even making a profit (if you’re among the lucky few who have the know-how and the right vessel).

Welcome to the yachting lifestyle.

Offsetting the Costs of Owning a Yacht

Chartering out your personal yacht to offset ownership costs..

One of the greatest benefits of chartering your yacht is making some money from your investment when you’re not using it. It’s a simple way to offset the cost of something that would otherwise sit and cost money. It also gives you more to work with as far as keeping the yacht up to date.

Keep in mind, the service and maintenance of a yacht is expensive but also a primary factor in whether or not your yacht will continue to retain value or even exceed value. Since routine refittings and redesigns are often unavoidable and cost up to 10 percent of your yacht’s value each year, this option offers you the added benefit of maximizing profits as well as your enjoyment each time you decide to set sail on another vacation.

Yacht charter management is a strategy to not only maintain your yacht, but also pay less in the long run when it comes to costs of docking, maintenance, insurance, and other operating expenses for your yacht.

Selling Your Yacht for Profit

Gaining a positive reputation among a network of yacht enthusiasts..

Net profits from a yacht charter are a faraway dream for most, but not impossible for some. Having a company to manage your charter within a flourishing network of yachters will help maximize your return on investment. There are some makes, models, and routes that are much more popular, and it pays to know where to best place your investment from the start, as unlike the trend with most types of cars or boats, not all yachts immediately begin depreciating in value.

Opening your vessel up to a network of yacht enthusiasts also increases the likelihood that your yacht will gain a positive reputation, thus more value among buyers or anyone interested in a yacht charter, making it much more desirable for both charter guests and purchases—that is, if it is a well-managed operation. It’s much more likely a prospect looking to buy your yacht will take it for a spin before purchasing.

Built-for-Profit Vessel

Some yachts are specifically designed to make money..

Having a yacht that is custom-built for charters or, put simply, turning profits, is the best way to go about using a yacht charter solely for investment purposes. It’s not impossible to make money with a yacht charter, but it also takes a good amount of experience and skill to get the job done right.

There are so many dynamic factors that are involved with running a successful yacht for charter operation, and one of the main things to keep in mind is the quality of service you’re providing your customers. This will be a factor in determining how much your vessel is worth to your yacht charter guests.

Owning a yacht for charter is profitable in more ways than one, but getting all the moving parts right requires some know-how and expertise with yacht charters. Remember, you can offset the cost of owning your yacht, sell your yacht for a profit, or design a yacht for money-making purposes—the dream is possible with help from experts.

Be it profit or pleasure, a yacht yields a lifetime of happiness.

Go to Knowledgebase

Destinations

- Amalfi Boat Charter

- Galapagos Luxury Boat

- Thailand Boat

- Cruising The Ionian Islands

- Yacht Rental Maine

- Juneau Yacht Charters

- Yacht in Bora Bora

- Sail Juneau

- Yacht Charter Hvar

Yachts & Yacht Builders

- Beneteau Sailing Yachts

- Hatteras Yachts

- Sunreef Sailing Catamaran

- Mangusta Yacht

- Elysian Yacht Charter

- Ferretti Yachts

- Endless Summer Yacht

- Benetti Yachts

- Fountaine Pajot Catamaran

- Sherakhan Yacht

Luxury Charters

- Luxury Yacht Vacation

- Yacht Charter Santorini

- Sailing Norway

- Miami Fl to Bahamas By Boat

- Tortola Boat Charters

- Corsica Yacht Charter

- Catamaran Charter Corfu

- Yacht Charter Cannes

Set your search criteria to find the perfect yacht

- Alaska Australia Bahamas BVI Caribbean Croatia Florida France Galapagos Greece Indonesia Italy Malaysia Maldives Mexico Mediterranean New England Norway Spain Thailand Tahiti Turkey

- Motor Yacht Catamaran Sailing Boats

- 2 4 6 8 10 12 12+

Search by yacht name

Is Owning a Yacht for Charter Profitable? Things to Consider

This article is a treasure map guiding future entrepreneurs through the sparkling waters of the yacht charter business. By diving into it, you'll uncover whether owning a yacht for charter really is as profitable as it sounds, alongside essential considerations to navigate by.

We'll explore the initial costs, from purchasing the yacht to docking fees, and maintenance expenses that ensure your vessel remains in tip-top shape.

Plus, we'll sail through understanding market demand, choosing the right type of yacht for your target audience, and the legalities to keep everything smooth sailing. Marketing strategies to make your yacht the one everyone wants to book and how to provide unforgettable experiences for your guests are also on the deck.

Can Owning a Yacht Charter Business Really Profitable?

Owning a yacht for charter can indeed be profitable, though it's rare for such an investment to "pay for itself" entirely. The profitability of a yacht charter business hinges on various strategies, including offsetting ownership costs, selling the yacht for a profit, and designing a yacht specifically for profit-making purposes. The dream of making a profit from a yacht charter is achievable with expert guidance and a strategic approach.

- Offsetting the Costs of Owning a Yacht: Chartering your yacht can be a smart way to make some money when you're not using it, helping to offset the cost of ownership. This strategy provides income and assists in keeping the yacht up-to-date, which is crucial since service and maintenance, which can cost up to 10% of the yacht's value annually, are key to retaining or even increasing its value.

- Selling Your Yacht for Profit: While net profits from yacht charters may seem like a distant dream for many, it's not out of reach for those with the right knowledge and vessel. A well-managed yacht within a thriving network can significantly enhance your return on investment. The popularity of certain makes, models, and routes can make a big difference, and a positive reputation can increase your yacht's value and desirability.

- Built-for-Profit Vessel: Some yachts are designed with profit in mind, tailored for charter operations. Success in this area requires experience, skill, and a focus on the quality of service provided to customers, which directly impacts the vessel's worth to charter guests.

How Much Do Charter Boat Owners Make?

The financial landscape of owning a yacht charter business in the United States presents a promising but varied picture.

According to industry insights, the average annual revenue for a yacht charter business owner ranges impressively from $300,000 to over $1 million , highlighting the lucrative potential of the industry. * This revenue is influenced by numerous factors, including the size of the fleet, the yacht's popularity and location, and overall demand for yacht charters.

Yacht charter businesses enjoy a healthy profit margin of approximately 20-30% , indicating that a significant portion of revenue converts into profit. * This profitability is influenced by several key factors, such as the business's location, with coastal destinations or luxury vacation spots being more profitable, and the size and type of yacht, as larger and more luxurious vessels often command higher rental fees.

Operating costs, including maintenance, insurance, dock fees, and crew salaries, play a crucial role in determining the owner's take-home income.

Efficient management and cost control can mitigate these expenses, allowing owners to maximize their profits. The average salary range for yacht charter business owners in the US varies, with most earning between $80,000 and $150,000 annually, not including additional profits generated from the business. *

To maximize revenue potential, yacht charter business owners are advised to offer a diverse range of yacht options, establish strong partnerships with local tourism agencies and hotels, invest in effective marketing strategies, provide exceptional customer service, and stay abreast of market trends to adjust pricing strategies accordingly.

What to Consider for a Yacht Charter Business Profitability

Launching a yacht charter business is both exciting and challenging, requiring a strategic approach to ensure profitability.

The success of such an endeavor hinges on several key factors, including the choice of location, yacht selection, effective marketing , and operational management.

Additionally, understanding the dynamics of charter demand, managing operational costs, and navigating regulatory landscapes are crucial.

This section will explore these critical considerations, offering insights to help you make informed decisions and steer your yacht charter business towards financial success.

The choice of location is paramount. Destinations like the Mediterranean , Caribbean, Spain, Greece, and Croatia are hotspots for yacht charters, offering breathtaking scenery and favorable sailing conditions.

The right location can significantly impact your booking rates and charter duration, directly affecting your bottom line.

Management and Marketing Strategies

Effective management and marketing are the backbones of a successful charter business. Partnering with experienced charter management companies can relieve the burden of day-to-day operations, from booking to maintenance. Moreover, leveraging marketing strategies, such as digital advertising and social media, can enhance your visibility and attract more clients.

Type of Yacht

The yacht's type, size, and amenities play a crucial role in its appeal to potential customers. Luxury yachts equipped with modern amenities and spacious accommodations can command higher charter fees, appealing to clients seeking an exclusive vacation experience.

Charter Demand and Seasonality

Understanding the demand and seasonality in your chosen location is crucial. High season periods often yield higher booking rates and prices, but it's essential to also consider shoulder seasons for extended operational periods.

Operating Costs and Expenses

Owning a yacht comes with significant operating costs, including maintenance, crew salaries, insurance, and docking fees. Calculating these expenses accurately is vital to ensure your charter business remains financially viable.

Regulatory and Legal Considerations

Navigating the regulatory and legal aspects of chartering is essential. Compliance with maritime laws, safety regulations, and insurance requirements protects your business and ensures a safe experience for your guests.

Key Takeaways on Owning a Yacht to Charter

- Strategic Location and Yacht Selection: The profitability of a yacht charter business significantly depends on choosing the right location and the types of yachts in your fleet. These decisions directly influence your ability to attract customers and command competitive charter fees.

- Effective Marketing and Operational Management: Implementing strong marketing strategies and efficient operational management practices are essential for maximizing booking rates, enhancing customer satisfaction, and, ultimately, ensuring a profitable business model.

- Cost Management and Regulatory Compliance: Careful management of operational costs and adherence to regulatory and legal requirements are crucial for maintaining a healthy bottom line. These factors affect the yacht charter business's overall financial performance and sustainability.

Frequently Asked Questions

Is owning a yacht for charter profitable.

Yes, it can be, provided you invest wisely, manage efficiently, and market effectively. The profitability hinges on several factors, including the yacht's location, type, and how well it's operated and marketed.

How Much Can Yacht Charter Owners Make?

Earnings vary widely based on numerous factors, including the yacht's size, type, location, and operational efficiency. With the right strategy, yacht charter owners can achieve significant returns on investment.

What Are the Best Strategies to Maximize Yacht Charter Revenue?

To maximize revenue, focus on selecting a popular charter location, investing in a desirable yacht type, implementing effective marketing and management strategies, optimizing booking rates through dynamic pricing, and maintaining the yacht in pristine condition to attract repeat business and referrals.

Table of contents

Recommended Posts

Sign up to our newsletter..

Lorem ipsum dolor sit amet, consectetur adipiscing.

Want to learn more about Peek Pro? See it in action during our live demo

See related posts

Essential Haunted House Advertisement Tips for 2024

Guide To Start a Zip Line Business: Cost and Challenges

Top Immersive Experience Examples to Inspire You

- Transportation & Logistics

- Yacht Charter Market

"Market Intelligence for High-Geared Performance"

Yacht Charter Market Size, Share & COVID-19 Impact Analysis, By Yacht Type (Motor Yacht, Sailing Yacht, and Others), By Yacht Size (Up to 40m, 40 to 60 m, and Above 60m), By End-use (Leisure, Business, and Others), By Contract Type (Bareboat and Crewed), and Regional Forecasts, 2023-2030

Last Updated: June 24, 2024 | Format: PDF | Report ID: FBI105123

- Segmentation

- Methodology

- Infographics

- Request Sample PDF

KEY MARKET INSIGHTS

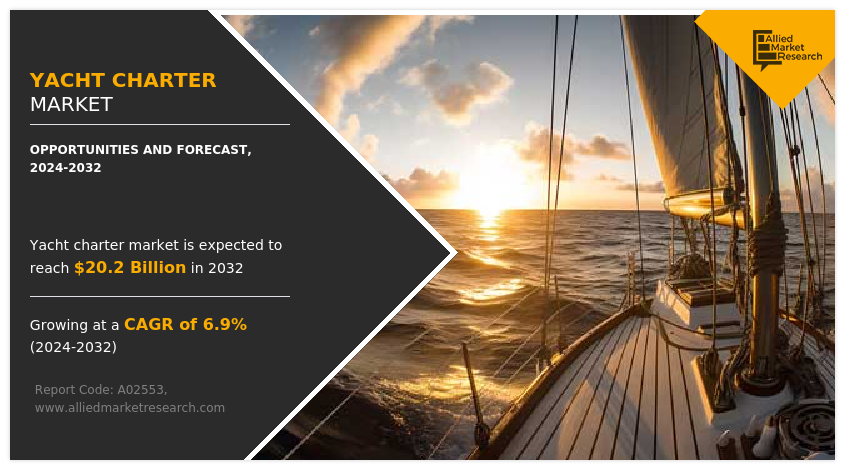

The global yacht charter market size was valued at USD 7.22 billion in 2022. The market is projected to grow from USD 7.59 billion in 2023 to USD 11.06 billion by 2030, exhibiting a CAGR of 5.5% during the forecast period.

A yacht charter is a service for hiring boats for recreational and leisure purposes. Yachts can be privately owned by individuals or companies or rented for charter. Professionally crewed yachts are equipped with luxurious amenities. These yachts are chartered for corporate and leisure purposes and offer a seamless luxury experience with the highest comfort and standards. Yachts are used for sailing and fishing in some parts of the world, especially in European countries. They offer all the benefits, from great adventures to total relaxation.

OEM constantly develops high-speed and luxury feature yachts to meet the increasing demand for marine tourism and water sports activities. Yacht rental companies also offer convenient booking of charter yachts through online platforms and mobile applications. Therefore, the market is expected to become popular in the coming years.

COVID-19 IMPACT

Decrease in Yacht Charter Demand Amid COVID-19 to Hamper Market Growth

The tourism segment witnessed a decline in growth during 2020 owing to adverse effects on the global tourism industry and a decline in the number of tourists visiting tourist places. The COVID-19 pandemic has severely impacted the travel and tourism industry, especially the yacht charter industry, which has stalled due to the rapid spread of the virus worldwide. This pandemic has caused vast uncertainty in the industry and a panic situation for all the members of the industrial value chain involved in it as they cannot forecast the resuming of the yacht rental business. Industry players are taking steps to overcome the uncertainty created by the pandemic, including safety and precautionary measures in charter contracts. However, people were optimistic that the charter market will recover soon once the pandemic eases. In 2022, the U.S. yacht sales started normalizing after witnessing solid growth in the past two years. In 2022, consumer spending patterns changed from yachting activities to other accessible activities, travel, music concerts, and sporting events.

In Europe, Asia Pacific, Latin America, and the Middle East & Africa, the growth of yacht charter slowed down during 2020 due to uncertainties. However, the market returned to normalcy and will show strong growth over the next few years.

LATEST TRENDS

Request a Free sample to learn more about this report.

Favorable Trends Associated with Marine Tourism and Private Island Resorts to Aid Market Augmentation

Marine tourism has a positive impact on economic growth in several ways. It also earns foreign exchange and contributes to government revenue. It creates jobs and makes an essential contribution to the local economy. In addition, it provides various sociocultural benefits such as strengthening communities and promoting sustainable tourism. Many countries worldwide are developing policies to strengthen the coastal tourism sector due to climate change and environmental degradation.

The maritime policy of the European Union supports the growth of coastal tourism and marine economic activity.

- For example, in January 2021, the National Oceanic and Atmospheric Administration (NOAA) finalized the Blue Economy Strategy Plan, 2021-2025 to accelerate the growth of the American Blue Economy. This strategy focuses on five divisions, ocean exploration, tourism and recreation, maritime transport, water sports competitiveness, and coastal resilience.

India also plans to develop 78 marine tourist attractions in the coming years. Such initiatives will encourage the growth of marine tourism in the future and thus support market growth.

DRIVING FACTORS

Growing Popularity of Recreational Yachting and Marine Tourism Activities to Aid Market Expansion

The increasing disposable income of customers and the growing inclination toward marine tourism and leisure activities, such as sailing, are aiding market expansion. Recreational boating has been gaining popularity for the past few years, paving the way for yacht rental services. Moreover, advanced booking systems are permitting customers to charter yachts at the time of booking flight tickets, which is ultimately propelling the growth of the market.

Beneficial government initiatives and programs to boost marine tourism are expected to spur market growth. For example, the Indian government will develop infrastructure and services to support local tourism and port city tours to encourage cruise travel and increase maritime tourists to 1.5 million by 2030-31. The Indonesian government has also updated its maritime tourism policy by abolishing the CAIT license (Indonesian Territorial Customs Authorization). The policy predicts a significant increase in yacht visits to Indonesia, generating over USD 500 million in revenues.

RESTRAINING FACTORS

High Costs of Yacht Charter to Hinder the Market Growth

Yacht has a base rate or a weekly rate for renting it. The cost of a yacht charter depends on several factors such as the type of yacht, crew required, charter destination, local taxes, and basic costs. Therefore, there is a wide range of basic rates for charters. Additionally, charter rates range from USD 10,000 per week for smaller sailing yachts and catamarans to USD 150,000 per week for the most luxurious motor superyachts. In addition, hidden costs, such as taxes and Value-Added Tax (VAT), insurance, crew gratuities, and meal prepayments, are not mandatory but cost approximately 15-30% of the base fare and are collected before the charter.

For instance, the Bahamas announced a new tax rate of 10% VAT for all foreign-flagged charter yachts. This will be enforced on all charter contracts signed after the 1st of July 2022. This new addition to the 4% charter fee will total an additional 14% cost. It is similar to an expense account the captain can access during the charter. Such cost is a barrier to many developing countries’ customers, further restraining the yacht charter market growth.

SEGMENTATION

By contract type analysis.

Bareboat Segment to Hold a Major Market Share Due to the Privacy Offered

Based on contract type, the market is segmented into bareboat and crewed. The bareboat segment holds the largest share of the global market in value due to various benefits such as more independence and privacy offered by bareboat compared to crewed boats . A bareboat charter is an arrangement in which an individual charters a vessel and steers the boat without other crew or services. The individual or group renting the boat from the owner is responsible for caring for the boat.

Many bareboat charter companies also offer courses to train a person in basic navigation skills and prepare for the bareboat charter. Sometimes, these companies also offer captain charters. Most chartered bareboat yachts are up to 40 meters in length. People typically rent bareboat yachts for fishing, sporting events, or sailing from one destination to another. Crewed is the fastest-growing segment. Rising demand for superyachts, increasing cruise line participation, and hybrid business models are the factors responsible for growth of this segment.

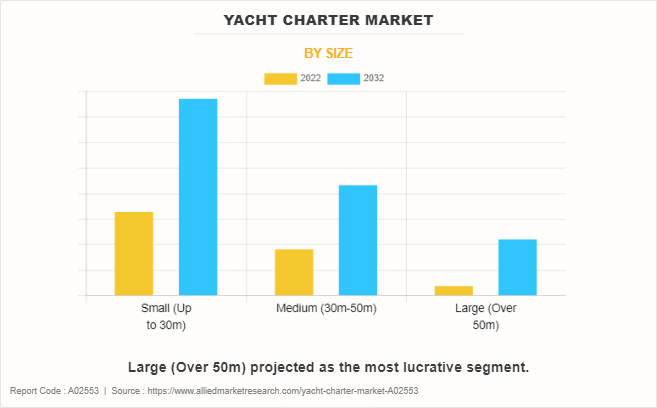

By Yacht Size Analysis

To know how our report can help streamline your business, Speak to Analyst

Up to 40m Segment to Capture the Largest Market Share Due to Affordability of Small Yacht Charters

Based on yacht size, the market is classified into up to 40m, 40 to 60m, and above 60m. The up to 40m segment accounts for the largest global market share. These yachts can be utilized for both personal activities in competitive and recreational boating activities purposes. The 40m charter has various advantages, including wind sailing capabilities that ensure wind direction and conserve fuel. End-users also favor yachts of up to 40m due to its affordability, low maintenance costs, fixed installation in shallow waters, and ease of use with low mooring costs.

Rapid urbanization, rising living standards, growing personal disposable incomes, and increasing upper-class population have increased individuals' ability to spend on luxury goods and leisure activities. Therefore, the yacht services market has also seen a significant increase in demand in recent years. Observed trends in yacht construction indicate that the average length of yachts is increasing by 3 cm each year. This is owing to the rising demand for superyachts and mega yachts in most developed countries and the overall surge in tourism in these regions. Therefore, the 40-60m segment is expected to grow significantly, while the above 60m segment exhibited the fastest growth rate during the forecast period.

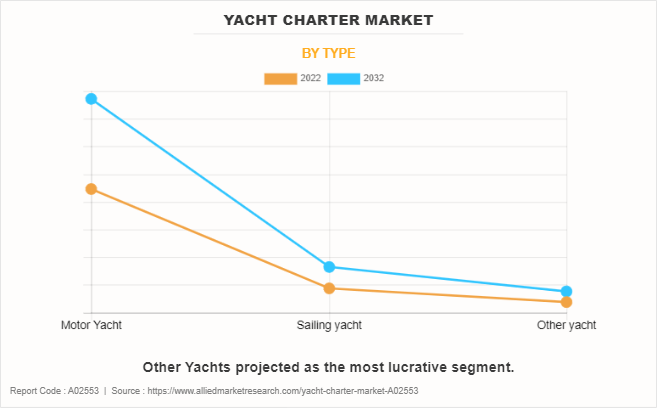

By Yacht Type Analysis

Motor Yacht Segment Dominates the Market Owing to Demand for Recreational Activities

The market is segmented based on yacht type into motor yacht, sailing yacht, and others.

The motor yacht segment holds the largest share globally and is expected to retain its leading position in the market during the forecast period. This growth can be attributed to the growing demand for motor yachts for personal and recreational activities in various countries worldwide. Motor yachts offer several advantages such as enhanced speed, power, and the ability to cover longer distances in less time. Moreover, motor yachts can be sailed in shallow water, allowing customers to navigate almost all coastlines and narrow and shallow creeks. Furthermore, increasing sporting activities, boating events, and tournaments create high demand for motor yachts.

The sailing yachts segment is expected to show steady growth in the market owing to the growing demand for environment-friendly yachts among people. Fuel emissions are a major pollutant in modern times, and the yacht industry contributes a substantial amount of the same. Moreover, sailing yachts are cheaper than other yachts and can travel more distances than motor yachts.

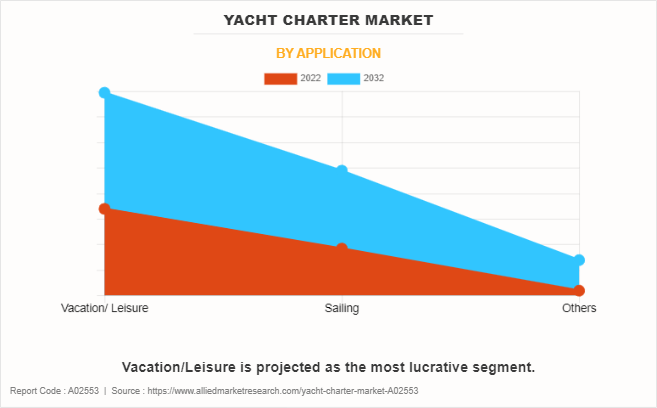

By End-user Analysis

Leisure Segment to Account for the Largest Market Share Due to the Rising Number of High Net Worth Individuals

The market is further segmented into leisure, business, and others based on end-user.

The leisure segment held the major global market share in 2022 due to increased tourism. The increasing inclination toward luxury cruising drives the yacht rental industry, especially from High-Net-Worth Individuals (HNWI) and Ultra-High Net Worth Individuals (UHNWI) worldwide.

The emergence of new tourist destinations offering luxury cruises and beautiful scenery has encouraged wealthy and ultra-rich people worldwide to discover these tourist destinations. Moreover, leading companies focus more on providing enhanced and extensive luxury cruising for their customers by developing premium features such as infrastructure, internet facilities, and bars and restaurants, which is expected further to boost the yacht industry in the leisure segment.

The business segment is gaining popularity in the market as the yacht business is a simple concept and is structured much like any other profit-earning business. Higher-class individuals or high-tax payers are increasing their investment in yachts and operating them actively for profit through third-party management services or themselves. Significantly, the U.S. buyers who fall under the high-income tax brackets choose this ownership option.

For instance, in April 2020, MYSEA announced its appointment as the Global Charter Central Agent of M/Y FLEUR Yacht with several exceptional facilities such as a retractable roof, Jacuzzis, and outdoor cinema, among others.

REGIONAL INSIGHTS

Europe Yacht Charter Market Size, 2022 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

Europe Dominates the Market Due to Well-Established Tourism Industry in the Region

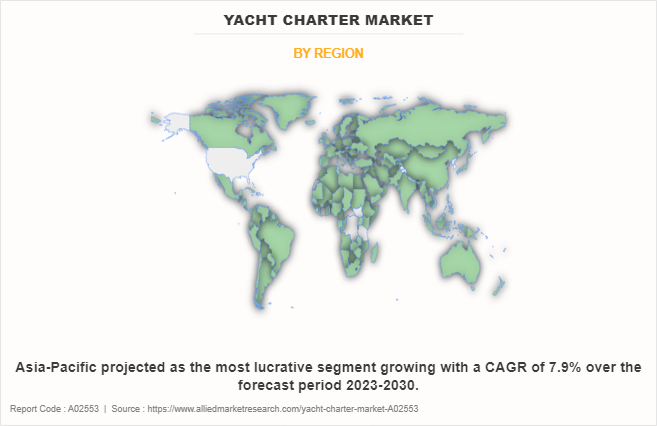

Geographically, the market is segmented into Asia Pacific, Europe, North America, and the Rest of the World.

Europe held the largest yacht charter market share in 2022. The region will likely dominate the market due to the high growth of sea tourism and the rising number of tourist destinations. Countries, such as Croatia, Greece, France, Spain, and Italy, are the major tourist destinations. The increasing popularity of fishing activities and water sports and rising number of upper-class individuals are expected to drive the development of the market in the region. European flight bookings, cooperation with online demand for charter service providers, and increased craft permits issued are expected to boost market growth. The region's wealthy population is also likely to drive market growth.

North America holds the second most important position in the market as the region's diverse coastlines have great cruise destinations. The U.S. ranks first in this regional market due to the presence of major charter hubs in the country.

The Asia Pacific yacht charter market is expected to record the highest CAGR in the coming years. This growth has been attributed to the rapid increase in urbanization, rising living standards, and rising disposable income, leading to the evolution of individual tastes. The growing popularity of recreational activities, such as fishing and water sports, in Thailand, Malaysia, Singapore, China, Japan and Australia, and increasing maritime tourism, present excellent opportunities for yacht hiring companies. Moreover, aggressive government initiatives to develop maritime tourism, especially in countries, such as China and India, are expected to boost market growth.

KEY INDUSTRY PLAYERS

Significant Product Offerings by Dream Yacht Charter to Enhance its Market Prospects

Dream Yacht Charter is the world's leading yacht specialist in charter management, brokerage, and private yacht ownership. Loic Bonnet founded the company in 2000 and is headquartered in Maryland, U.S. The company is a pioneer in providing easy and hassle-free charters, expert advice, and bespoke solutions. The company is well known for offering new sailing destinations and a wide range of charters, including Captain, Bareboat, Sabbatical, Crewed, and Cabined. The company currently owns over 1,000 yachts in around 60 locations worldwide. The company owns some of the world's largest yacht builders, including Dufour, Aquila, and Fontaine Pajot. In 2019, the company launched the MoreWomenAtSea campaign to encourage more women to go to sea and get a sailing education. In February 2020, the company announced a partnership with river cruise specialist Les Canalous to expand and facilitate boat holidays on canals across Europe.

LIST OF KEY COMPANIES PROFILED:

- Worldwide Boat LLC (U.S.)

- Dream Yacht Group (U.S.)

- Northrop & Johnson (France)

- Sailo Inc. (Monaco)

- Camper & Nicholsons (Japan)

- Ocean Independence (Switzerland)

- Burgess Yachts (U.K.)

- The Moorings Limited (U.S.)

- Boatbookings (U.K.)

- Ritzy Charters LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Camper & Nicholsons joined Yacht Club de Monaco to consolidate aims to foster innovation and spearhead a sustainable future for the yachting sector. This project brings together key stakeholders from the yachting sector for economic and sustainable growth.

- January 2023: Ocean Independence added 40m ATLANTIKA and 37m SUD to the Ocean Independence charter fleet. ATLANTIKA now accommodates up to 10 guests in five comfortable suite staterooms and offers entertainment and tranquility split across all decks.

- September 2022 : The Biograd company Angelina Yacht Charter acquired 85% share in the Split-based charter company Ultra Sailing. With this acquisition, it will be the largest charter company in Croatia. The joint fleet of yachts will reach more than 260 vessels.

- January 2022 : The new luxury yacht Berg was launched. This will be 55m long and become the first luxury charter yacht to cruise on the Nile. Berge’s charter route cruises between Luxor and Aswan, taking in the scenery of the most famous stretch of river, showcasing architecture and natural beauty.

- January 2021 : Burgess declared a new partnership with Marine Solutions in India. With this collaboration, Burgess aims to serve its existing clients better and build new relationships in India, enhancing its charter offering in the Indian Ocean.

REPORT COVERAGE

An Infographic Representation of Yacht Charter Market

To get information on various segments, share your queries with us

The market research report provides a detailed market analysis and focuses on key aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Report Scope & Segmentation

|

|

| 2019-2030 |

| 2022 |

| 2023 |

| 2023-2030 |

| 2019-2021 |

| CAGR of 5.5% from 2023 to 2030 |

| Value (USD billion) |

|

|

| |

| |

| |

|

Frequently Asked Questions

Fortune Business Insights research report says that the market was valued at USD 7.22 billion in 2022 and is projected to reach USD 11.06 billion in 2030.

The market is expected to register a CAGR of 5.5% during the forecast period.

Growing popularity of recreational yachting and marine tourism activities will drive the global market growth.

Europe led the market in 2022.

Seeking Comprehensive Intelligence on Different Markets? Get in Touch with Our Experts

- STUDY PERIOD: 2019-2030

- BASE YEAR: 2022

- HISTORICAL DATA: 2019-2021

- NO OF PAGES: 140

Personalize this Research

- Granular Research on Specified Regions or Segments

- Companies Profiled based on User Requirement

- Broader Insights Pertaining to a Specific Segment or Region

- Breaking Down Competitive Landscape as per Your Requirement

- Other Specific Requirement on Customization

Automotive & Transportation Clients

Related Reports

- Leisure Boat Market

- Small Boats Market

- Electric Boat Market

Client Testimonials

“We are quite happy with the methodology you outlined. We really appreciate the time your team has spent on this project, and the efforts of your team to answer our questions.”

“Thanks a million. The report looks great!”

“Thanks for the excellent report and the insights regarding the lactose market.”

“I liked the report; would it be possible to send me the PPT version as I want to use a few slides in an internal presentation that I am preparing.”

“This report is really well done and we really appreciate it! Again, I may have questions as we dig in deeper. Thanks again for some really good work.”

“Kudos to your team. Thank you very much for your support and agility to answer our questions.”

“We appreciate you and your team taking out time to share the report and data file with us, and we are grateful for the flexibility provided to modify the document as per request. This does help us in our business decision making. We would be pleased to work with you again, and hope to continue our business relationship long into the future.”

“I want to first congratulate you on the great work done on the Medical Platforms project. Thank you so much for all your efforts.”

“Thank you very much. I really appreciate the work your team has done. I feel very comfortable recommending your services to some of the other startups that I’m working with, and will likely establish a good long partnership with you.”

“We received the below report on the U.S. market from you. We were very satisfied with the report.”

“I just finished my first pass-through of the report. Great work! Thank you!”

“Thanks again for the great work on our last partnership. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U.S.”

“We feel positive about the results. Based on the presented results, we will do strategic review of this new information and might commission a detailed study on some of the modules included in the report after end of the year. Overall we are very satisfied and please pass on the praise to the team. Thank you for the co-operation!”

“Thank you very much for the very good report. I have another requirement on cutting tools, paper crafts and decorative items.”

“We are happy with the professionalism of your in-house research team as well as the quality of your research reports. Looking forward to work together on similar projects”

“We appreciate the teamwork and efficiency for such an exhaustive and comprehensive report. The data offered to us was exactly what we were looking for. Thank you!”

“I recommend Fortune Business Insights for their honesty and flexibility. Not only that they were very responsive and dealt with all my questions very quickly but they also responded honestly and flexibly to the detailed requests from us in preparing the research report. We value them as a research company worthy of building long-term relationships.”

“Well done Fortune Business Insights! The report covered all the points and was very detailed. Looking forward to work together in the future”

“It has been a delightful experience working with you guys. Thank you Fortune Business Insights for your efforts and prompt response”

“I had a great experience working with Fortune Business Insights. The report was very accurate and as per my requirements. Very satisfied with the overall report as it has helped me to build strategies for my business”

“This is regarding the recent report I bought from Fortune Business insights. Remarkable job and great efforts by your research team. I would also like to thank the back end team for offering a continuous support and stitching together a report that is so comprehensive and exhaustive”

“Please pass on our sincere thanks to the whole team at Fortune Business Insights. This is a very good piece of work and will be very helpful to us going forward. We know where we will be getting business intelligence from in the future.”

“Thank you for sending the market report and data. It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.”

Get in Touch with Us

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245 (APAC)

[email protected]

- Request Sample

Sharing this report over the email

The global yacht charter market size was valued at $7.22 billion in 2022 & is projected to grow from $7.59 billion in 2023 to $11.06 billion by 2030

Read More at:-

- Yachting for beginners

- Owning a yacht

- Motor Yachts

- Sailing Yacht

- Indian Ocean

- Mediterranean

- Buying or Selling a Yacht

- Yachting Events

- FAQ – Luxury Yacht Charter

- FAQ – Buying a Yacht

- FAQ – Sell your Yacht

- How Much Does It Cost To Charter A Luxury Yacht?

- All our Blog Post & News

Can Owning a Yacht to Charter (Really) Be Profitable?

When contemplating the possibility of investing in a luxury yacht, questions often arise as to what kind of return an owner can expect on their investment beyond a fun and exciting experience out on the open water.

In this article, we’ll answer the question whether or not a regular yacht owner can rent it out and expect to make a profit out of it.

What Yacht Owners Need to Know Before Entering the Charter Business

Owning a yacht and chartering it are two completely different things. If you don’t own a yacht yet, the issue is even worse. Here are some valuable reminders.

Owning a yacht (for a charter business or not) comes with a hefty price tag.

The initial cost of purchasing a yacht is high, and it is just the beginning. One must also take into account the maintenance and operation costs that come with owning a yacht. The operation costs include the cost of fuel, mooring fees, crew salary, communication expenses, yacht insurance, and P&I. These costs alone can quickly add up and make up a significant portion of the expenses associated with owning a yacht.

On top of the operation costs, one must also consider the maintenance cost. Keeping a yacht in top shape requires a considerable investment in shipyard costs, replacing broken parts, painting, and regular cleaning. Ongoing maintenance is essential to keep the yacht seaworthy and in excellent condition.

To know more, read: How much does it really cost to own a yacht?

Chartering yachts is a regular (and regulated) business

Before investing into a yacht and charter it, it is crucial to thoroughly research the regulations and requirements for operating a charter business in your specific location.

This may involve obtaining various licenses and certifications, as well as adhering to safety and liability standards. You’ll also need to carefully consider your target market, pricing strategies, and marketing efforts.

Building strong relationships with brokers and other industry professionals is also the difference between a profitable yacht charter venture and one that follows the sunk costs fallacy.

So, although entering the charter business can seem profitable and easy at first glance, it does requires careful planning and a commitment to even get started.

Yacht charters services are far from being the passive income you may have in mind

To an outsider, chartering a yacht can almost seem like a good passive income source. But it is rarely the case.

A yacht charter is a service that involves a lot of work if you intend to do it yourself: hiring a crew, doing the maintenance of your yacht, preparing food & beverage, getting moorings… the list of tasks can be very long. If you are not from the industry or if you intend to rent your yacht as a side hustle, you will quickly realize why people use the services of yacht brokers !

What makes chartering your yacht profitably challenging

While owning a yacht available for charter can be an exciting venture, there are several drawbacks to consider. These include:

The financial burden of a yacht for charter is serious

As we mentioned before, owning a yacht is a significant financial commitment. The initial purchase cost, along with ongoing expenses such as maintenance, crew salaries, insurance, and berthing fees, can be substantial.

If the yacht does not generate enough charter bookings, it may become a financial burden rather than a profitable investment.

Charter Demand and Seasonality can break your profitability

The demand for yacht charters can be seasonal and location-dependent. If your yacht is based in an area with limited charter seasons or faces high competition during peak times, it may be challenging to secure enough bookings to cover the costs.

This can result in periods of low or no income.

Wear and Tear from constant charters can ramp up maintenance costs

Chartering your yacht means it will be used by different groups of guests. This can lead to increased wear and tear on the yacht’s interior, equipment, and systems. Regular maintenance and repairs are necessary to keep the yacht in good condition, which can add to your expenses.

Using your own yacht personnally automatically decreases your income potential

When your yacht is available for charter, it may limit your personal use of the vessel. Popular charter periods may coincide with times when you would like to enjoy the yacht privately. Balancing personal use and charter bookings can be a challenge, especially if you have high expectations for personal enjoyment.

Alternatively, every time you use your yacht, it’s a yacht charter income revenue that is automatically lost.

You need guest Satisfaction to have bookings

As a yacht owner offering charters, guest satisfaction becomes crucial. Ensuring a positive charter experience requires careful management, including hiring and training competent crew, maintaining high standards of service, and addressing any guest concerns or issues promptly. Meeting guest expectations can be demanding and time-consuming.

Regulatory and Legal aspects can hinder your cashflow

Operating a yacht for charter involves complying with various regulations and legal requirements. These can include safety inspections, licensing, tax obligations, and compliance with local maritime laws. Staying updated and compliant with these regulations can be complex and may require professional assistance.

The yacht charter market is volatile

The yacht charter market can be influenced by economic fluctuations and changes in consumer preferences. Economic downturns or shifts in travel trends can impact the demand for luxury yacht charters. It is essential to monitor market conditions and adapt your charter business accordingly.

It is crucial to carefully evaluate these drawbacks against your personal goals and financial capabilities before deciding to own a yacht available for charter. Conducting thorough market research, seeking professional advice, and creating a comprehensive business plan can help miti

Who can reasonably expect to make money by chartering their yacht?

Not everybody can be profitable chartering their own yacht, or having a fleet of yachts for rent.

Most people that rent their own yacht without a professional broker by their side aren’t actually making money, even though their little side hustle can help them finance their hobby.

Being constantly profitable chartering your yacht involves a lot of work combined with the appropriate vessel in the right location, and some experts to market it and manage it. Only then one can reasonably expect to see extra cashflow.

How you can optimise the Return on Investment (ROI) of a Yacht for Charter

Considering numerous factors, the return on investment (ROI) of a yacht for charter can significantly vary. Just keep in mind that while some yacht owners can generate profitable returns, the vast majority of yachts may experience lower or even negative ROI.

If you don’t have a yacht yet, conduct a serious market research

In most business, market research is one of the key to success. Yacht charter is not an exception. If you already have your own yacht, your options are naturally limited. However, if you are new to yachting and are simply contemplating the idea of buying a yacht with the plan to rent it out to break even or be profitable, then seriously study your market.

Better yet, get the help of a professionnal broker that might have all the insiders tips you need before making a big mistake and kill your potential ROI forever.

Have your yacht for charter in popular areas where there is demand

The ROI largely depends upon the level of demand and popularity of yacht charters in specific locations. Popular destinations with high demand, such as Mediterranean or the Caribbean can provide better opportunities for a higher ROI. But, due to the competition among yacht owners, the pricing and occupancy rates might be impacted.

Have appropriate charter prices to ensure a good occupancy rate

Rental rates significantly contribute to deciding the ROI of a yacht. Higher rates may result in a favorable ROI only if the yacht is consistent in securing more bookings throughout the charter season. The ability to attract clients is important to maximize returns: an empty boat costs money and doesn’t generate income.

Operating Costs and Expenses must be effective

The costs of fleet management including crew salaries, maintenance and repair, insurance, fuel, provisioning, marketing, and administrative expenses have a direct impact on the ROI. Effective management of these costs can non only help you to break-even, but also hopefully to generate real profits.

Carefully choose your type of yacht (and size) to ensure profitability

The size and type of yacht directly influence its charter appeal and ROI. Larger, more luxurious yachts typically command higher charter rates, attracting high-end clientele and potentially generating better ROI. However, larger yachts may also have higher operating and maintenance costs, and they can be harder to fill.

Your yachts always need to be kept in good condition

Nobody want to charter a yacht that looks beaten up and dangerous.

The condition and age of the yacht are the key factors that affect its charter appeal and subsequent rental rates. Well-maintained yachts in excellent condition are highly likely to receive more bookings and generate higher rental rates, thereby maximizing the ROI.

Older yachts may require frequent repairs and renovations, which can influence profitability.

Management and Marketing are key to rent our your yacht, just like any other business

Implementing effective management and marketing strategies to increase client bookings, occupancy rates, and optimizing charter pricing can significantly influence the ROI.

Working with a professional yacht management company or charter broker can help attract clients and maximize the ROI.

What are the costs involved in offering a yacht for charter ?

When offering a yacht for charter, there are several costs involved that will naturally have to be lower than your total charter income in order to make sure your venture remains profitable .

These costs can vary depending on various factors such as the size and type of the yacht, the charter location, the duration of the charter, and the services provided. Here are some common costs to consider:

- Yacht Acquisition or Ownership Costs: Flag registration. As some yacht flag can be more advantageous than others for tax purposes, but also for the diploma your crew will require to navigate the yacht.

- Crew Costs : The crew is essential for operating the yacht and providing a high-quality charter experience. Crew costs typically include salaries, training, uniforms. The crew size will depend on the size and type of the yacht.

- Fuel and Dockage: Fuel costs can be significant, especially for larger yachts. Dockage fees also need to be considered, as yachts often require berthing in marinas or ports in between charters and winterizing.

- Maintenance and Repairs: Yachts require regular maintenance and occasional repairs to ensure they are in optimal condition for charters. These costs can include engine maintenance, hull cleaning, system servicing, and cosmetic repairs.

- Insurance: Yachts need comprehensive insurance coverage for protection against potential risks such as accidents, damage, theft, and liability. The cost of insurance can vary depending on the yacht’s value, size, and cruising area.

- Marketing and Brokerage Fees: To attract charter clients, marketing efforts are necessary. This may involve creating a website, advertising, attending boat shows, and working with charter brokers. Brokerage fees are also applicable if you choose to work with charter brokers to promote and book charters on your behalf.

- Ancillary Services: Additional services such as water toys, scuba diving equipment, entertainment systems, internet connectivity, and crew uniforms may incur additional costs. These extras can enhance the charter experience and attract more clients.

It’s important to note that the actual costs can vary significantly depending on the specifics of your yacht and the charter operation. Working with a professional yacht management company or charter broker can provide valuable insights and help you estimate these costs more accurately. Contact our team to get more details.

Read also : The yacht charter experience ladder

Read also : FRACTIONAL YACHT OWNERSHIP EVERYTHING YOU NEED TO KNO W

The Best Alternative to Reduce the Cost of Yacht Ownership: Fractional Ownership

Fractional ownership of a yacht is when an individual invests in only part of the yacht. This means there are comparatively more funds to spare for just a part of the yacht. So, the cost of owning and keeping a yacht in great condition is considerably reduced.

There are yacht chartering companies like the WI Yacht that allow individuals to own part of a yacht for some time during the year. This way, the cost of ownership is significantly less, but you do get the privilege of being a yacht owner.

Real also : Fractionnal yacht ownership : everythings you need to know

Key Takeaways on Owning a Yacht to Charter

Renting out profitably a yacht that you own is largely dependent upon having the right boat in the right location, the right plan, and in most cases the right broker by your side.

Knowing exactly what to expect before taking on this type of venture is essential as there is a certain level of risk involved when entering the yacht charter market, especially considering the costs involved in simply maintaining a yacht afloat.

Can every yacht owner be profitable by chartering their own yacht? No, but it can certainly decrease the overall cost of ownership.

And with the right set of conditions and a professional broker, some owners might even make a successful business out of it almost passively.

Get in touch with us if you own a yacht that you’d like to charter.

Frequently Asked Questions

Yachts from know shipyard are usually the most profitable for chartering. The key is a professional crew and a good central agent for your marketing.

Chartering a superyacht just offsets the costs. Majority of superyachts offered for charter earn money to offset expenses, they do not earn a profit.

If done in strategic areas and times of the year, chartering your own yacht can be extremely lucrative. An individual can make up to one hundred thousand or more in a single month. The key is to buy cheap, second-hand even, and then refurbish your boat.

Usually, banks offer loans for buying a yacht if you have a strong initial payment. There are personal loans available that people can use for such investments, but they come with higher rates of interest.

The standard rate of commission to the yacht charter company per yacht is 15%. This amount can increase or decrease, but just a little.

The income obtained from renting (or chartering) a yacht can sometimes cover all expenses incurred, but not always. So, owning a yacht for free by renting it out is possible, but not guaranteed.

The most popular yacht charter destinations are the United States of America, British Virgin Islands, the Bahamas, French Riviera & Monaco, Amalfi Coast, Croatia, and Greece.

Should you Sell a Yacht that Has a Loan? Our Advice

Yacht charter: how much does it cost all rental costs explained, you might also like.

What differentiates a yacht from a superyacht or a mega yacht?

Chartering Requirements and Regulations: A Guide for Boat Owners

What are the Fastest Cruising Catamaran on the Market?

- 0 Shopping Cart £ 0.00 -->

Can Investing in Yacht Charter be profitable today? Yacht Charter Market Analysis

In the last 15 years at Rodriquez Consulting we have served a variety of yacht charter companies and private owners who were keen on chartering their yachts. We have created a Yacht Charter Business Plan download because more often than not we are asked to help them with their business plan but often times startups can’ afford to rely entirely on our team from the start so we decided to poor in some of our knowledge into a ready made starting point. Undoubtedly the question we are asked most often is:

Is yacht charter profitable and/or is it a good business to get in? or Can investing in yacht charter be profitable in some ways?

In many industries the above questions would be rather simple to answer. However, in the yachting industry answering these questions with anything else other than “It depends..” requires us to get into a great level of details. At the very least, we need to get into the specifics of the size segment you choose, the primary geographic area and the yacht charter business model that you intend to implement.

Geography, Business Model, Size Segment of the yacht/boat/vessel

To most people Yacht Charter rates seem to be very high as an absolute per-week-value, but are they high enough when you consider the cost of the asset/s (the yacht/s) and its running costs? The latter can have a very large range as variable costs depending on how and where the vessel is managed and can make a significant difference. Ultimately, it the acquisition price (the price of the vessel) that is crucial but the variable and fix costs are the ones that can determine whether the operation (your yacht charter business) is profitable or not. If you are looking to build a business plan to charter yachts and get in the business this article will be useful, however, you might want to contact us for more ad-ho c support. Looking from outside the yachting industry, charter rates like those of M/Y Serene ( see our previous posts ) chartered by Bill Gates for over 2.5M$ a week, might sound as an exorbitant price to pay, but let us look at it differently than simply comparing the charter rate to the alleged value of the yacht at $300 millions. Indeed, if you take into account a rough estimate 10% of the [alleged] purchase value (or $30 Million) spent on running the yacht every year and at the number of potential clients that can pay such rates for a week of charter all of a sudden the weekly rate seems not as high any more.

The above mentioned ratio between purchase price, charter rates and running costs cannot be applied to all investments made on yachts that are on the charter market. Professionals in the yachting industry are aware of the fact that at least a good part of the success of the Turkish yachting industry is due not only to its marvellous geographic position and to its well balanced cost of labour of skilled boat builders. Turkey’s success is also thanks to the Turkish traditional gulet which would be often refer to as ‘ a lot of boat for the money’ . The latter type of vessel, indeed, has often made the fortune of charter companies and owners who can rent it well even if they are targeting customers that wouldn’t be able to charter similar size (65feet+) built in Holland or Italy for example. Very simply put, the average purchase value of these vessels is particularly interesting if compared to the quantity of space and comfortable accommodation they can offer.

Back to our original question, is investing in Yacht Charter profitable? At Rodriquez Consulting we would tend to say – YES – It can still be if you do it right !

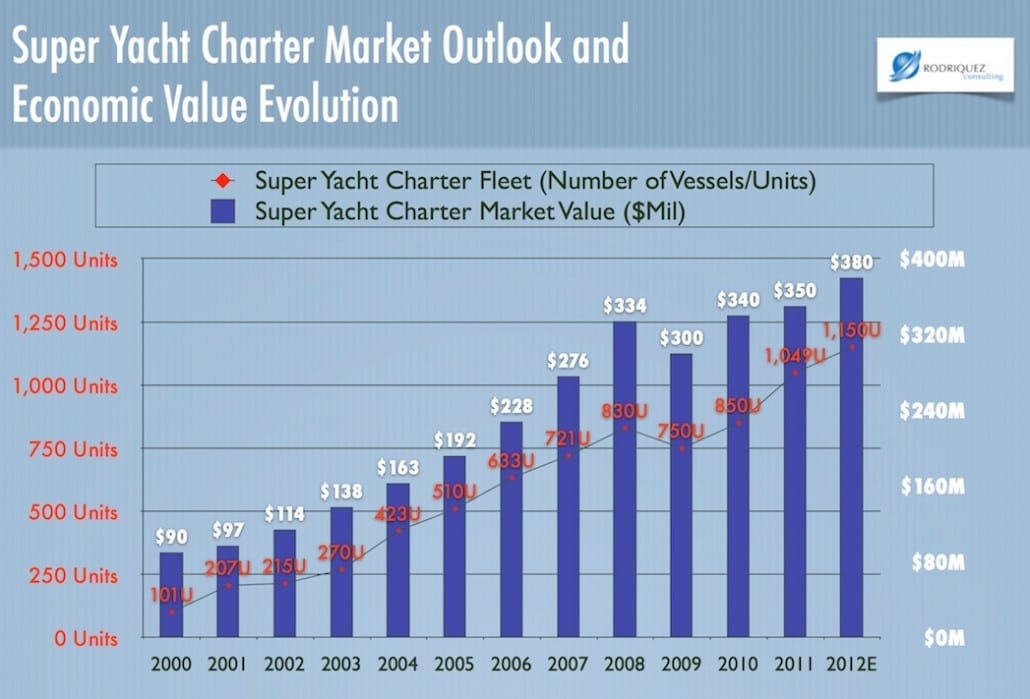

Let’s look at the historical trends of the Super Yacht Charter Market Analysis and its economic evolution from 2000 to 2012

[if you are looking for 2015-2020 contact us]

Super Yacht Charter Market Evolution

[if you are looking for 2015-2017 data click here]

Finding the right boat or yacht to charter

Rule 1: Whatever boat you think of buying get a great surveyor and a good yacht/ship survey done possibly choose a professional with yacht building experience

Finding the “right” boat is crucial in this process because the “right” boat will drive the type of clients who are interested in renting it, the price competitiveness, and maintenance costs. It is not uncommon though to incur into the common mistake to think that the right boat is the one you want to buy because much like cars, boats are an investment of passion, thus, are subject to one’s perception of beauty which might not be the same as your target market (your prospective charterers). For example, not long ago, I have stumbled upon a quite rare fiberglass UK-built fast sail yacht, the McGregor 65. A decent size yacht but yet, not too hard to handle even with only one or two skilled people on board. This boat was for sale at an asking price of slightly less than 100’000 GBP and in very good condition but most importantly it was built with the objective of having to do as little maintenance as possible.

Let’s look at yachts that are already depreciated

Sail Yacht McGregor 65

Turkish Gulet

The McGregor 65 was built to go fast upwind so unlike a traditional turkish gulet of similar size its max beam is not as generous, however, it requires much less maintenance than the latter and [it] is certainly not as roomy. Therefore a McGregor 65 would appeal more to clients that look for exciting sailing performances rather than sunbathing areas. The advantages of such a choice of vessel for a charter boat would certainly be: Low maintenance costs, Little or no crew to be employed , low cost of acquisition/purchase, slower depreciation, and ease of cross atlantic crossing to extend the season and sell more weekly or even daily charter periods, targeting a more sailing oriented niche of clients. The disadvantages; less cabins, smaller sunbathing areas and overall a less cozy party-type of boat that is less suitable for the occasional party-boat charterers. A vessel like the McGregor 65ft could also be chartered for regattas to customers that are into the sport of sailing rather than the vacation which is a good way to employ the vessel through not very sunny periods of the year or locations.

See our guide to buy your first boat.

It’s probably as interesting to point out that such a big vessel can easily cross the Atlantic, thus, it can be chartered during the Caribbean high season when the mediterranean one is low.

When we get to the motor yacht part of the charter business the ‘game’ gets a little more complicated, but don’t panic we can help here to feel free to pick our brain and contact us

Maintenance Costs of a Yacht and how it relates to engines and propulsion

The engines and the propulsion system plays a big role in the maintenance of a vessel. The fuel cost, which are variable depending on the power installed, become a cost element on the client vacation. This cost certainly has an influence on the attractiveness of the yacht to the end client. Speed and performance play a relatively minor role unless we consider a smaller size segment 25-45ft feet whereby charters can be a day long or even less. In the above motor yacht scenario, the classic Bagliettos are interestingly underestimated boats in terms of space the provide and low acquisition cost (less than £200’000 ) but they are not that appealing to the younger crowd who looks for more modern looking boats and performance.

In the motor yacht industry and especially in areas like South Florida, fishing boats and fishing boat charters are very popular and a plethora of interesting boats is available on the pre-owned market. As one would expect fishing boat charters tend to be shorter and often operated by the boat owners or professionals captains.

Yacht Charter Brokerage – On commission

The vast majority or charter companies (and the biggest ones) specialising in large yacht charter (super yachts) as don’t own the vessels or own a very small % of the vessels the charter and are essentially brokers or at times manage the vessel on behalf of the owner (depending on size). There are also established brands like Moorings or Sunsail who have engineered managed ownership programs where owners are tight to a management contracts that let the charter companies rent the vessel so that the owner can have a paid management service to make up for running costs for most of the year.

Average use of yacht by its owners

We could say, across the board, that the average use of a Yacht by its owner rarely exceeds the 2-3 weeks per year in the Mediterranean therefore, a managed yacht is a good compromise to manage your own boat if your yacht investment is not properly oriented to profit and as a prospective yacht owner you are thinking to mainly cover cost ownership and depreciation.

Starting a yacht charter business

If instead, you have decided to do yacht charters as a serious business and turn a profit at the end of the year you might want to contact us (or use the live chat to get your consultation booked) and get your numbers right. Your brand and charter offer needs to be well structured and differentiated from the competition. Considering the information we have provided above, I hope it is clear that those who are in business for profit (owning the vessel/s) will have a tough time against those who are essentially covering the cost of ownership and therefore are running at a loss.

Therefore, it is of utmost importance to plan your investment and offer positioning as thoroughly as possible and with the most updated amount of information on current yacht charter price trends (see an example of older data in the slide below).

Yacht Charter Trends, historical data

Marketing Yacht Charters online

Marketing via modern technologies and hopping on the latest trends like the new rent-a-boat type of platforms such as BoardaBoat.com in the UK and Cruzin.com , now merged with BoatSetter.com in the U.S. can certainly help making Yacht Charter a successful and profitable business.

Some more marketing savvy owners also use more established non-specific platforms like Airbnb.com to sell as much as possible. If you are serious about marketing your charter service or vessels, we certainly recommend not to underestimate the value of a well optimised (SEO-friendly) and attractive website. Marketing to sell the experience of boat/yacht charter as TheYachtWeek.com has successfully done, rather than the mere temporary use of the asset can be a good idea depending on the target market one is looking to reach.

What new tech-based charter companies say:

When we met with Frank Sykes from BoardaBoat.com to get more information on this new innovative platform some time ago, we started our meeting with a candid question to understand his view on the business opportunity. Not surprisingly, he answered exactly what we expected him to:

“We identified the market opportunity from the high volume of key under-utilised asset. By making the boating experience easier to access at a better value, sustainable private ownership and charter, becomes a reality”

Utlimately, in our opinion the answer is YES, Yacht Chartering can still be a profitable line of business to be in. As a boat owner we would suggest to associate with companies like Upyacht.com or BoatBookings.com or even trying to invest in such companies together with managing your own yacht which would put you in a strategic investor position.

However, it now requires more advanced techniques from a marketing point of view and thoroughly planned operations. If you have read this post so far and this is the business you are in or you are thinking of going in don’t hesitate to contact us for a preliminary consultation or

Yacht Charter Business Plan – MS Excel Template – FILE ONLY (Updated)

Yacht Charter Business Plan – Ms Excel Template + Consulting Session

You might also like.

You might also be interested in

Are you looking for a valid alternative to Jetski? At first we wanted to create a flexible dinghy for our superyacht owners. However, we decided to have more fun and create something for a larger user base. Something to be safer and more user-friendly than a jetski (more stable and more user friendly). A boat […]

Website or Name of Company

First Name:

Email Address:

- Cool Hunting

- Marine Investment Opportunities

- Marketing Tools and Tips

- Off-Market Yacht Investment Opportunities

- Yacht Charter Business

- Yachting Industry News

- Your cart is empty! Return to shop

Yacht Charter Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

Global Yacht Charter Market is Segmented by Charter Type (Bareboat, Cabin, and Crewed), Yacht Type (Sailing Yacht, Motorboat Yacht, and Other Yacht Types), and Geography (North America, Europe, Asia-Pacific, and the Rest of the World). The Report Offers Market Size and Forecasts for the Yacht Charter Market in Value (USD Billion) for the Above Segments.

- Yacht Charter Market Size

Single User License

Team License

Corporate License

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR (2024 - 2029) | 5.79 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Europe |

| Market Concentration | Medium |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Yacht Charter Market Analysis

The Yacht Charter Market is expected to register a CAGR of 5.79% during the forecast period.

The market was valued at USD 18.9 billion in 2021, and it is projected to reach USD 26.5 billion by 2027,

The market was negatively impacted by the COVID-19 pandemic in 2020. Worldwide, the yacht charter industry was brought to a standstill by the pandemic. The impact was clear on the industry, as several companies confronted instabilities with their supply chain. Furthermore, the lack of skilled labor impacted the market growth. The key players are doing their best to counter the situation. Additionally, rising global participation in competitive and recreational boating activities and growing corporate tourism activities are expected to significantly support the demand of the target market.

Over the medium term, the factors such as the increasing demand for competitive and recreational boating activities, the purchasing power of people, and rising disposable income are anticipated to drive the yacht charter market during the forecast period. Seeing the potential of the market, numerous associated businesses, like yacht management, that support the construction of new yachts are also entering the market. Yacht charter companies are currently concentrating on vertical integration with major yacht manufacturers to intensify their revenue.

However, factors like high costs of yacht taxation policies and rentals in certain regions are impeding the market growth.

Asia Pacific is expected to be the fastest-growing region. Rising recreational activity popularity, as evidenced by increased participation in marine recreational activities in countries such as Australia, Indonesia, Thailand, and Singapore, is expected to support regional growth.

- Yacht Charter Market Trends

Augmentation in Fleet Size by Key Players is Propelling the Market Growth

Numerous yacht charter companies are adding new yachts to remain ahead of their competitors, as several charter companies have contracts with yacht manufacturers to ensure that the new yachts are provided to them for chartering. For instance,

- In February 2022, Imperial Yacht announced that with the collaboration of Amels and Damen Yachting, the launch of Project AMELS 242-07 is scheduled to be delivered this summer.

- In March 2021, Imperial Yacht announced the signing of a new 100-meter project, Project Titanium, in collaboration with The Italian Sea Group, the parent company of Admiral Yachts. Project Titanium, which is scheduled to be delivered in 2025.

With the addition of new yachts in the fleet, charter companies invested huge amounts in upgrading their fleet. For instance,

- In May 2021, Northrop & Johnson announced closing deals, including the 120-foot (37m) Benetti motor yacht TANUSHA, two Pershing yachts LOUNOR, and AMJU, the 130-foot (39.7m) classic superyacht ARIONAS from Lürssen.

Europe and North America are Anticipated to Lead the Market

Europe is preferred as one of the top destinations for marine culture. Northern Europe has a very rich culture of yacht charters. Countries, like Germany, Sweden, England, Denmark, Scotland, Ireland, Norway, and Russia, have the existence of a variety of options to select from motor yachts, luxury yachts, and crewed yachts. Several superyachts are also available for charter along with expedition/explorer yachts. The summer season is the finest time to charter a yacht in Europe.

Correspondingly, most clients in North America selected to visit chartered destinations to avail of large discounts. In the United States, consumers are oriented toward comfort over performance. The Northern American yachting season is from May to October, whereas in South America, it runs from January to September. Florida has one of the largest gatherings of private superyachts. It has two coastal borders, one in the Atlantic and the other in the Gulf of Mexico, and it holds around 30,000 lakes.

Several countries are reforming their tax regulation and rules, which is concerning the yacht charter market. For instance, in January 2020, the French Tax Authorities released an official tax bulletin with some new rules, which will affect charter contracts signed after March 30, 2020. The VAT will be charged at a 20% rate when the yacht is sailing in EU water bodies, and there will be no VAT while sailing in international waters. If any boat is in EU waters, it is fully subjected to VAT.

As developments in the current situation are constant and fluid, one would expect that certain measures are put in place, comprising governmental and legislations directives, which would give some assurance to the industry.

Yacht Charter Industry Overview

The yacht charter market is moderately fragmented, with many active players. The market is witnessing the emergence of many new start-ups. Some of the major players in the market are Burgess, Northrop & Johnson, and Dream Yacht Charter. The companies are expanding their presence by increasing their fleet size and partnering with small players. Key players are expanding their presence by tapping into new and unexplored markets.

- In February 2022, Northrop & Johnson made a partnership with NetJets. This partnership will provide customers with luxurious, comfortable, and memorable travel experiences.

- In May 2021, Ocean Independence announced the addition of SOULMATE to the Ocean Independence charter fleet. SOULMATE is an award-winning 34m Dreamline superyacht that combines an elegant Italian interior with comfort and safety.

- In May 2020, Ocean Independence announced that it added 44m Burger motor yacht PURE BLISS to its charter fleet. This seven-stateroom superyacht can accommodate 12 guests, with exceptional features, such as elevator access up to three decks and a great range of water sports toys.

Yacht Charter Market Leaders

Dream Yacht Charter

OceanBLUE Yachts Ltd.

Simpson Marine

Northrop and Johnson

*Disclaimer: Major Players sorted in no particular order

Yacht Charter Market News

- In January 2022, Northrop & Johnson announced a partnership with Master & Dynamic, a renowned audio brand. This partnership will provide a Northrop & Johnson client with Master & Dynamic headphones, especially curated playlists, alongside other wellness items ideal for enjoying onboard a luxury yacht.

- In January 2021, Burgess announced a new partnership with Marine Solutions in India. With this collaboration, Burgess aims to better serve its existing clients and build new relationships in India, enhancing its charter offering in the Indian Ocean.

- In January 2021, Northrop & Johnson announced a partnership with Ulysse Nardin to further enhance the offerings, experience, and value to the wealthy and discerning clientele.

Yacht Charter Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 By Charter Type

5.1.1 Bareboat

5.1.2 Cabin

5.1.3 Crewed

5.2 By Yacht Source

5.2.1 Sailing Yacht

5.2.2 Motorboat Yacht

5.2.3 Other Yacht Sources

5.3 By Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.1.3 Rest of North America

5.3.2 Europe

5.3.2.1 Germany

5.3.2.2 United Kingdom

5.3.2.3 France

5.3.2.4 Rest of Europe

5.3.3 Asia-Pacific

5.3.3.1 India

5.3.3.2 China

5.3.3.3 Japan

5.3.3.4 South Korea

5.3.3.5 Rest of Asia-Pacific

5.3.4 Rest of the World

5.3.4.1 Brazil

5.3.4.2 Mexico

5.3.4.3 United Arab Emirates

5.3.4.4 Other Countries

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.2 Company Profiles

6.2.1 Dream Yacht Charter

6.2.2 Yachtico

6.2.3 Asta Yachting

6.2.4 OceanBLUE Yachts Ltd

6.2.5 Simpson Marine

6.2.6 Ocean Independence

6.2.7 Imperial Yachts

6.2.8 Northrop and Johnson

6.2.10 Burgess

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Yacht Charter Industry Segmentation

Yacht charters are typically used for leisure, business, and vacation activities. A yacht charter offers a convenient and easy way to enjoy a long holiday with friends and family without owning a yacht. Yacht charter firms provide the yacht and deliver the best itinerary as per the requirements of the clients, with crew and captain and online or on-call support till total charter duration.

The yacht charter market is segmented by charter type, yacht type, and geography. By charter type, the market is segmented into the bareboat, cabin, and crewed. By yacht type, the market is segmented into sailing yacht, motorboat yacht, and other yacht types.

By geography, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World.

| By Charter Type | |

| Bareboat | |

| Cabin | |

| Crewed |

| By Yacht Source | |

| Sailing Yacht | |

| Motorboat Yacht | |

| Other Yacht Sources |

| By Geography | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||