- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Yacht Insurance

Finding the perfect coverage has never been easier.

Insurance doesn’t have to be boring. That’s why we hired Sara East to be our BA insurance writer. Maggie specializes in making mundane subjects hella-entertaining.

Yachts are a luxurious way to be on the water, but owning a yacht means having the right insurance in the event of damage or being destroyed. Because of their price, repair or replacement is likely to be very expensive making the proper coverage crucial for boat owners.

Before using your yacht, an independent agent can work with you to create a customized yacht insurance policy to your specific watercraft, its value, and how you use it.

Boating Statistics

No one likes to think about the dangers of boating, but accidents can happen and it's best to be prepared in the event that you face unexpected hardship. Whether you hit another boater, have an incident with a passenger, or your boat is damaged while being transported or docked, lots of things can lead to a financial headache for you.

Here are some statistics about boating accidents.

- Cabin motorboats, which include yachts, accounted for 14% of all boating accidents

- Only about 20% of all boaters who drowned were on vessels larger than 21 feet

- Operator inattention was cited as the leading cause of accidents involving cabin motorboats

What Is Yacht Insurance and What Does It Cover?

Yacht insurance is a specialized type of boat insurance for luxury boats. Yachts can be used for personal as well as commercial use, so insurance policies must be created to accommodate each of those needs.

While yachts, like most boats, depreciate over time, they still generally have a much higher than average value. Because of their high values, a standard boat insurance policy may not provide enough coverage for your vessel.

The components of yacht insurance are similar to standard boat insurance coverage.

- Bodily injury and property damage liability: Covers the costs associated with injuries or property damage you cause to another person, as well as legal fees. If the liability limits in your yacht insurance policy are not adequate to protect your assets from a lawsuit, you may want to consider buying an umbrella liability policy , which provides a much higher liability limit.

- Collision coverage: Pays for damage to your boat after a collision with another boat or object.

- Comprehensive coverage: Covers non-collision damage or loss, including theft, fire, vandalism, or damage caused by an object other than another boat.

Additional yacht insurance options to consider

- Uninsured/underinsured boaters insurance: Covers any damage or injuries from an accident with an uninsured or underinsured boater. Since boat insurance is rarely required by law, if you have a significant amount invested in a vessel, this is a good insurance option to discuss with your agent.

- Medical payments coverage: Covers medical expenses and funeral expenses for anyone on that is injured, entering, leaving or while on your boat.

- Equipment and personal effects coverage: Pay to repair or replace damaged or lost items such as gear, fishing equipment, cameras, and other personal belongings.

An independent agent can work with you to determine the appropriate coverage for your needs. Because these agents work with multiple insurance companies, they can help protect all of your interests with a broad range of insurance coverage, all from one agency office.

Is Yacht Insurance Different from Standard Boat Insurance?

Yacht insurance provides similar types of coverage as standard boat insurance . However, yachts have some specific differences from standard boats, and yacht owners generally need certain protection that regular boat insurance does not provide.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances.

Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000. In addition, yacht policies can include coverage for raising and removing a sunken yacht, while boat policies generally do not include this coverage.

Is Yacht Insurance Required?

Yacht insurance is not typically required by state law. However, sailboats often do have insurance requirements. So, if you have a sailing yacht, insurance may be required by law.

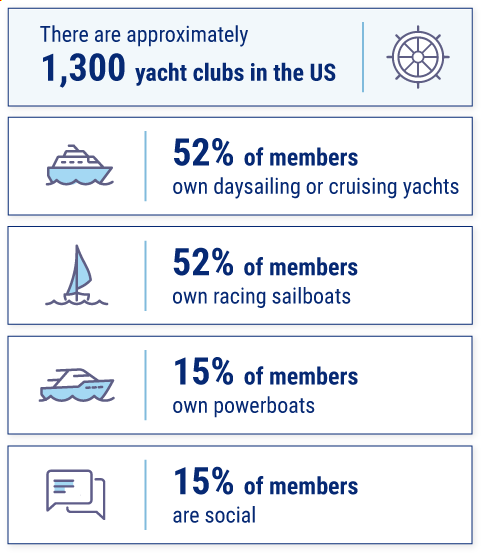

Yacht club membership statistics

You will also need to buy insurance to protect your investment in your vessel if you finance the purchase of your yacht through a lender.

Many marinas require that you have insurance in order to slip your boat at the marina. Check your local marina's guidelines, and be sure to learn about your state’s laws and regulations.

Do I Need Yacht Insurance?

A yacht can range in price from $300,000 to several million dollars. Purchasing one is a big investment and having the ability to insure your investment can ease your mind if there's an accident or your yacht needs repairs or replacement.

Insuring your yacht is also not just about the boat. In the event that an injured party files a liability claim against you, you will want to have enough coverage in place to protect your boat, home, savings, investments, and future income.

Assessing your financial situation will help you to determine how much yacht insurance you need.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

How an Independent Insurance Agent Can Help with Yacht Insurance

A local independent agent will talk with you, free of charge, to learn about your yacht and insurance needs. They'll gather multiple quotes for you from several different companies and help you compare options and rates. Your agent can assist you with every aspect of your insurance and will be your point of contact if you need to file a claim.

An independent agent can help to prevent gaps in coverage that leave you exposed to risk. You will know you are getting the right coverage for your needs, and that you are not paying for any unnecessary coverage.

https://www.ussailing.org/wp-content/uploads/2018/01/Demographics2010.pdf

- Search Search Please fill out this field.

- Personal Finance

Yacht Insurance: What It Means, How It Works

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

- Property Insurance: Definition and How Coverage Works

- The Importance of Property Insurance

- Personal Liability Insurance

- Scheduled Personal Property

- Non-Scheduled Personal Property

- Floater Insurance

- Unscheduled Property Floater

- Wear-and-Tear Exclusion

- Jewelry Floater

- Designer Clothes

- Consignments

- Guide to Landlord Insurance

- Best Landlord Insurance

- Do You Need Mobile Home Insurance?

- Modular vs. Manufactured Home Insurance

- How to Insure Your Tiny Home

- Yachts CURRENT ARTICLE

- Umbrella Insurance

- How Umbrella Policies Work

What Is Yacht Insurance?

Yacht insurance is an insurance policy that provides indemnity liability coverage for a sailing vessel. It includes liability coverage for bodily injury or damage to the property of others and damage to personal property on the vessel. Depending on the insurance provider, this insurance could also include gas delivery, towing, and assistance if your yacht gets stranded.

Key Takeaways

- Yacht insurance provides indemnity liability coverage for a sailing vessel.

- It has two principal parts: hull insurance and protection and indemnity (P&I) insurance.

- While there is no legal agreed upon length that separates a yacht from a pleasure boat, generally it is considered to be somewhere between 27 and 30 feet.

Understanding Yacht Insurance

Some companies specialize in providing coverage for antique and classic boats. You can choose between an actual cash value or agreed value policy. The former is cheaper but factors in depreciation and market value, so your payout will be less. Some policies include discounts based on your boating education, safety features, and whether you have a hybrid or electric boat. Some companies also offer a package deal that decreases the rate on a yacht insurance policy if you purchase additional policies, such as for your home or car.

Boats are defined as vessels under 197 feet long, while ships are 197 feet long or longer. There is no agreed upon length for a yacht , but they are generally considered to be at least 30 feet long. A vessel under 27 feet is considered a pleasure boat.

Although there isn't a standard definition of what the size of a yacht is, we can see that there is a general agreement within a range. With that being said, this general range falls within class 2 and class 3 of the Federal boat classification system.

For its own purposes, the National Boat Owners Association marks the dividing line at 27 feet. Most yacht coverage is broader and more specialized than pleasure boat coverage, because larger vessels travel farther and are exposed to greater risks.

Yacht insurance is broader and more specialized than pleasure boat coverage, due to the fact that a yacht can sail farther and thus runs greater risks.

A yacht insurance deductible, the amount of money you must pay out of your own pocket before your insurance kicks in, is usually a percentage of the insured value. A 1% deductible, for example, means that a boat insured for $100,000 would have a $1,000 deductible. Most lenders allow a maximum deductible of 2% of the insured value.

Generally, yacht insurance coverage does not include wear and tear, gradual deterioration, marine life, marring, denting, scratching, animal damage, osmosis, blistering, electrolysis, manufacturer’s defects, defects in design, and ice and freezing.

Two Parts of Yacht Insurance

There are two principal sections of a yacht insurance policy.

Hull insurance

Hull insurance is an all-risk, direct damage coverage that includes an agreed amount of hull coverage. That amount is settled on when the policy is written, and in the case of a total loss it will be paid out in full. In addition, there is replacement cost coverage on partial losses, though sails, canvas, batteries, outboards, and sometimes outdrives are not include and instead are subject to depreciation.

Protection and indemnity (P&I)

Protection and indemnity (P&I) insurance is the broadest of all liability coverages, and because maritime law is particular, you will need coverages that are designed for those exposures. Longshore and harbor workers’ coverage and Jones Act coverage (for the yacht’s crew) are included and important, because your losses in these areas could run into six figures. P&I will cover any judgements against you and also pays for your defense in admiralty courts .

Insurance Information Institute. " Boat insurance and safety: Boat insurance coverage ." Accessed Jan. 31, 2022.

National Boat Owners Association (NBOA). " The Best Yacht Insurance Rates ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Insurance Discounts ." Accessed Jan. 31, 2022.

Malhotra Insurance. " Watercraft and Boat Insurance: Is There a Difference? " Accessed Jan. 31, 2022.

U.S. Government Publishing Office. " Coast Guard, DOT ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What is a normal deductible? " Accessed Jan. 31, 2022.

Absolute Insurance of Palm Beach County, Inc. " Yacht Insurance ." Accessed Jan. 31, 2022.

International Marine Underwriters. " Commercial Hull and P&I ." Accessed Jan. 31, 2022.

DiscoverBoating.com. " Boat Insurance Guide: Boat Insurance Coverage FAQs: What should I look for in a yacht policy? " Accessed Jan. 31, 2022.

Gallagher Charter Lakes. " Protection & Indemnity Insurance – What is it??? " Accessed Jan. 31, 2022.

:max_bytes(150000):strip_icc():format(webp)/jet_ski_103967155-56a0e1d45f9b58eba4b4cd01.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Yacht In s urance

The best yacht insurance rates.

From America's boat insurance experts since 1984

Get a Quote

- Marine Insurance

- Boat Insurance Quote

- Company Information

- Testimonials

- Boat Safety

- Boat Towing

- Boat Insurance Guide

- Yacht Insurance

- Insurance Glossary

- Report A Claim

- California Boat Insurance

- Maryland Boat Insurance

- Michigan Boat Insurance

- Texas Boat Insurance

- North Carolina Boat Insurance

- New York Boat Insurance

- Florida Boat Insurance

- Minnesota Boat Insurance

- Louisiana Boat Insurance

The Differences between Boat & Yacht Insurance

When you look at a boat insurance policy, you'll notice the language is unlike your typical homeowner's or auto policy. What you may not know is that vessel insurance can even vary from policy to policy, depending on a variety of factors.

Yachts are classified as vessels 27 feet or more in length, while boats are 26 feet or less. No matter what type of vessel you have, when it comes to the type of policy, seek out Agreed Value. Agreed Value policies are cover all damages, except for sails, outboard motors, canvas covers, cushions or other specified items. They do not reflect depreciation or market value, which means you will get a greater settlement in the event of a claim. Other policies such as Actual Cash Value may be cheaper, but they also factor in depreciation and market value and will subtract that from your payout.

Also, when it comes to navigation limit, boat and yacht insurance policies can vary due to different exposures. For example, a boat policy typically includes unlimited overland transportation on a trailer, while a larger yacht policy would restrict overland trailering to only several hundred miles.

Deductible amounts can also differ. A yacht policy can offer deductibles of up to 3 percent for any hull damage. However, deductibles for a total loss, marine electronics loss or a windstorm loss can vary depending on your particular policy. By contrast, a boat policy offers a flat deductible, typically of $250, $500 or $1,000.

Because yachts inherently incur more risk due to their size and navigation, the liability feature of yacht insurance provides broad coverage designed to shield you from the effects of the maritime law. Your coverage is much broader than with a typical watercraft liability policy, and offers protection to permissive users, captain and crew liabilities, along with the Jones Act, a federal law that allows a seaman who gets injured on the job to bring a suit for damages against his or her employer.

Besides, yacht insurance addresses salvage to a damaged yacht, legal liability to remove a sunken wreck and uninsured boater coverages. In a typical boat policy, only general liability protection is included. For example, if your boat sinks in the Great Lakes or any of its tributaries, the U.S. Coast Guard says it must be raised. There will be salvage costs, fuel clean-up - and you'll have to pay the bill regardless of your coverage.

While most yacht policies provide salvage coverage, they do so in different ways. Some choose to limit the dollar coverage to a stated amount or percentage of the hull amount.

Another very important part of the salvage issue is wreck removal. Some companies include wreck removal under their hull coverage, which then limits its value. A true yacht policy will include it under the protection and indemnity limit, which will provide much higher limits and additional coverage.

Get Your Insurance Quote

Another difference is that in yacht policies, your legal defense is in addition to protection and indemnity limits, while boat policies offer legal defense within the limit of liability.

Yacht policies have warranties, including the seaworthiness, navigation limits territories and navigation lay-up limits. While some boat policies do not require warranties, others may incorporate them.

Many boaters consider adding their vessels to their homeowner's insurance in an attempt to reduce their costs. Although the cost is substantially less when you add a boat to a homeowner's policy, but you don't get near the coverage. In this case, the old adage still holds true - you get what you pay for. The bottom line is not the amount of your policy premium, but how much you will collect at the time of loss.

For more information on boat and yacht insurance, or to talk to an experienced agent about different coverage options, contact NBOA Marine Insurance. Representing several A+ rated carriers, their insurance specialists will be able to create a customized policy that fits your specific needs and would be happy to answer any questions you may have.

Call 1-800-248-3512 or start your online boat insurance quote today.

CELEBRATING 35 YEARS AS ONE OF THE NATION'S TOP INSURANCE PROVIDERS!

Yacht Insurance: A Complete Owner’s Guide

Michael Castorino Articles

Yacht insurance, also known as boat insurance, is a type of insurance that provides coverage for yachts or boats against potential risks or damages. Yacht insurance policies can protect yacht owners from financial losses associated with accidents, damage, theft, liability claims, and other unforeseen events that can occur while the yacht is in use or at rest.

Here are some key things you need to know about yacht insurance:

Yacht insurance policies typically cover a wide range of risks, including damage to the yacht, theft, vandalism, liability claims, medical payments, and more. The coverage may vary depending on the policy, so it’s important to carefully review the policy and understand what is covered and what is not. Yacht insurance policies typically offer different types of coverage, including:

- Hull coverage: This covers damages to the yacht’s hull, machinery, and equipment caused by accidents, collisions, or other covered events.

- Liability coverage: This provides protection if the yacht owner is found legally responsible for causing damage to another person’s property or injuring another person while operating the yacht.

- Medical payments coverage: This covers medical expenses for injuries sustained by the yacht owner, passengers, or crew while on board the yacht.

- Uninsured/underinsured boater coverage: This provides coverage if the yacht owner is involved in an accident with another boater who does not have insurance or has inadequate insurance.

- Personal property coverage: This covers personal belongings, such as electronics, furniture, and other items on board the yacht.

- Towing and assistance coverage: This covers the cost of towing and emergency assistance in case the yacht becomes disabled or stranded.

Coverage Limits

Yacht insurance policies typically have coverage limits, which are the maximum amount the insurance company will pay in case of a covered loss. It’s important to review and understand the coverage limits in your policy to ensure that you have adequate coverage to protect your yacht and assets.

The cost of yacht insurance premiums may vary depending on various factors, including the value and size of the yacht, its intended use, cruising area, the yacht owner’s experience, boating history, and the coverage options chosen. Higher-value yachts or those used for racing or cruising in remote areas may typically have higher premiums.

Deductibles

Yacht insurance policies may also include deductibles, which are the amount that the yacht owner is responsible for paying out of pocket before the insurance coverage kicks in. Higher deductibles may result in lower premiums, but it’s important to choose a deductible that you can comfortably afford in case of a claim.

Navigation Limits

Yacht insurance policies may have navigation limits, which are geographic areas where the yacht is covered to operate. It’s crucial to understand and adhere to these navigation limits as operating the yacht outside of the covered areas may result in a denial of coverage in case of a claim.

Additional Coverage

Yacht owners may have the option to add additional coverage to their yacht insurance policy, such as coverage for pollution liability, wreck removal, tender or dinghy coverage, and more. It’s important to discuss your specific needs with your insurance provider to determine if any additional coverage is necessary.

Safety Measures

Insurance companies may require yacht owners to adhere to certain safety measures, such as having safety equipment on board, following navigation guidelines, and completing safety courses. Adhering to these safety measures may help lower your premiums and reduce the risk of accidents or damage.

The Conclusion

Insuring your yacht is as important as routine maintenance and repairs. Accidents can happen at any time, so it is better to have the right amount and type of coverage before you hit the open waters. If you have recently purchased your first yacht or want to become part of a like-minded community of boat enthusiasts, joining a yacht club can offer many benefits. Lighthouse Point Yacht Club is one such club that provides benefits such as storage facilities for vessels, a fuel dock, a pump-out station, detailing services, and more. To become a member, give us a call today!

Related Posts

A Guide to Crafting the Perfect Day on the Ocean: Boating Activities for Every Enthusiast

Ace Your Game: The Exciting Tennis Scene at Lighthouse Point Yacht Club

Unlocking the Benefits of Swimming: Dive into the Junior Olympic Swimming Pool

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: Login to CRS

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Boat & Yacht Insurance

From small boats to large yachts, it’s smooth sailing with Chubb.

Whether you own a runabout, sailboat, yacht or mega-yacht with a full-time captain and crew, we offer some of the most comprehensive coverage and services available.

Our Products

For over a hundred years, we've offered unparalleled stability and protection with our boat and yacht insurance.

Coverage is available for all types of pleasure boats 35 feet and less, including bowriders, fishing, wake boats, and cabin cruisers, and for personal watercraft vessels like wave runners and jet skis.

Coverage is available for pleasure yachts 36 feet or greater in length and up to $3 million in value, and for captained vessels 70 feet or greater in length, valued at $3 million or more.

See the chubb difference.

Watch this short video to see how Chubb kept their client cruising when they experienced some trouble in the water.

Coming Out of Lay-Up

If your boat stays in lay-up over winter, you’ll need to take care of a few things before it’s ready for the following summer. Here are some suggestions to help you make sure your is ready for a successful launch and a safe and relaxing season.

Going Into Lay-Up

Once summer ends, many boat owners across the country will begin to prepare their vessels for winter storage. Read our full length "Going Into Lay-Up" brochure to help you complete this important lay-up process.

Related Coverage

From high-rise condos to historic buildings, we’ve got your home covered.

With liability coverage, let us be your personal peace-of-mind partners.

We help you stay ahead — and informed with these helpful tips and tricks

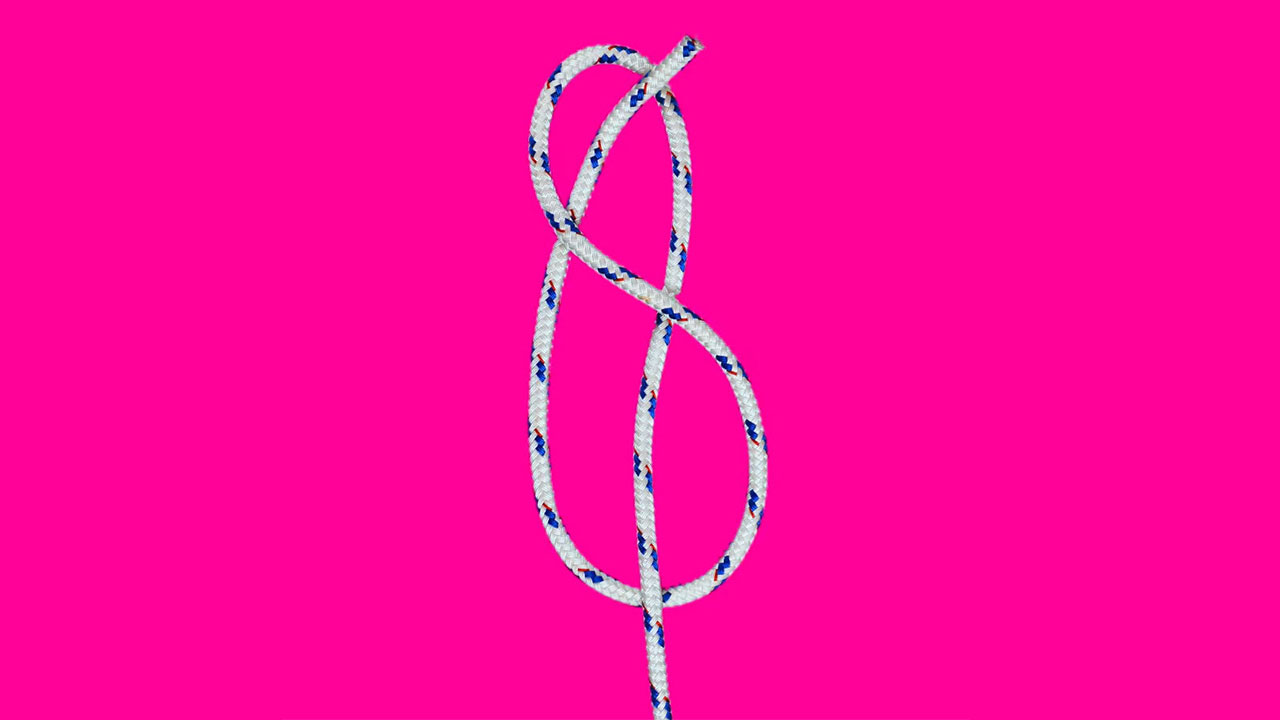

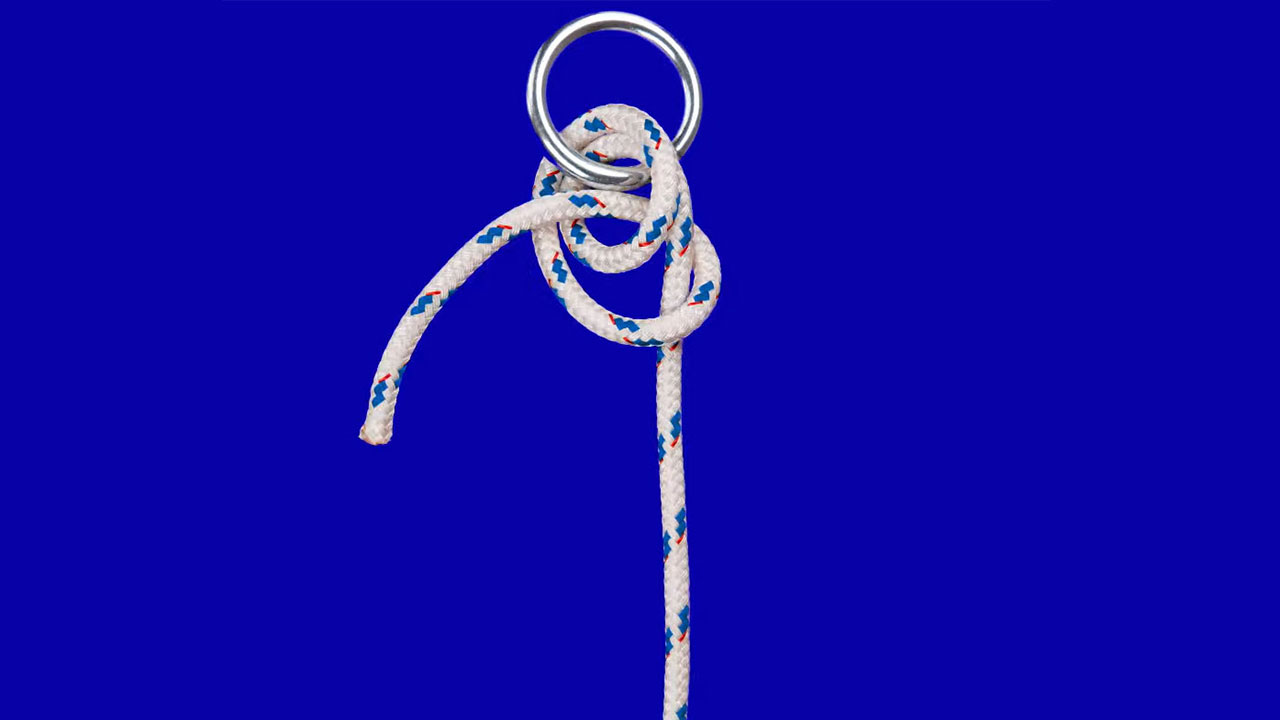

Figure eight knot.

An ideal knot to keep the free end of a line from running out of a block or fairlead.

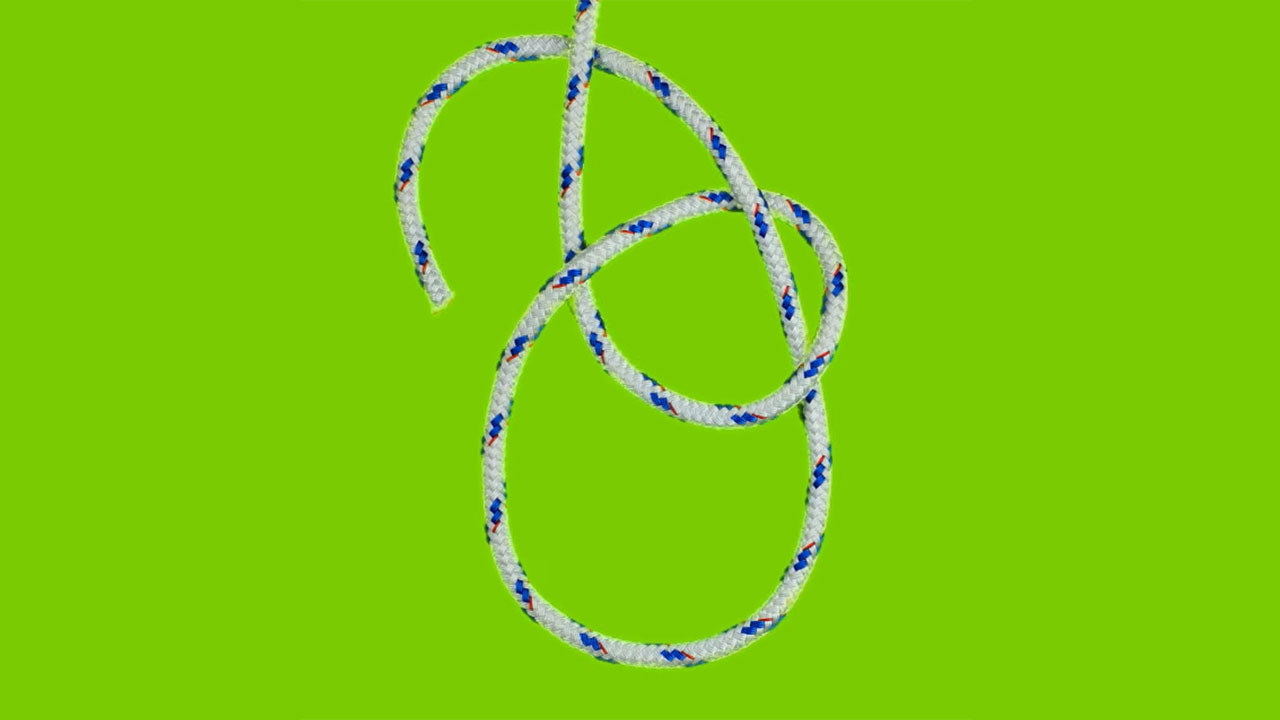

Bowline Knot

Sometimes referred to as the “King of Knots,” it forms a fixed loop that won’t slip, but is easy to untie.

Square Knot

Used at sea for reefing and furling sails.

Anchor Bend Knot

Used to secure a line to a ring on a buoy or anchor rode. A strong, chafe-resistant knot.

Two Half Hitches Knot

Reliable, quickly tied, and the hitch most often used in mooring.

Clove Hitch Knot

The general purpose hitch, used wherever you need a quick, simple way of securing a line around a post, railing, spar or cleat.

Find an Agent

Speak to an independent agent about your insurance needs.

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Boat Insurance

Start a boat insurance quote and get out on the water..

Or continue previous quote .

Manage Your Boat Insurance Policy

GEICO Marine (formerly Seaworthy) Policyholders

- Log in to GEICO Marine to manage your policy or call (877) 581-BOAT (2628)

- Mon - Fri 8:00 am - 10:00 pm, Sat - Sun 8:00 am - 9:15 pm

SkiSafe Policyholders

- Log in to SkiSafe to your policy or call (800) 225-6560

- Mon - Thu 9:00 am - 7:00 pm, Fri 9:00 am - 6:00 pm, Sat 9:30 am - 5:30 pm

Or call us at (800) 841-3005

Need a boat insurance quote?

Existing boat policyholder?

Get a boat insurance policy to protect your investment.

Boat insurance helps you protect your boat or personal watercraft (PWC) investment. So if you travel across lakes, rivers, or ocean waters of the United States we can help keep your peace of mind afloat. Whether you're looking for a new boat insurance policy or just to save money, we can help you get started with a free boat insurance quote.

Make boating better, together. Experience and a name you can trust go a long way when you're shopping for boat insurance. That's why the GEICO Marine Insurance Company has teamed with BoatUS , the nation's largest group of recreational boat owners. Since 1966, BoatUS has been helping to make boating safer, more affordable, and fun. Together, we share a passion for all things boating.

We all want cheap boat insurance rates, but customer service matters too. Protect your investment with boat insurance you can count on and get your free online boat insurance quote today.

Why do you need boat insurance?

A boat insurance policy helps protect you and your boat. If you don't have a separate boat insurance policy, you're probably underinsured. This could mean paying a lot out of pocket for accidents outside your control. Many homeowners policies cover minor boating risks but don't cover your needs sufficiently due to:

- Size restrictions

- Limitations on horsepower

- Limits on damage coverage

Check out our "boating insurance explained" video and article here for more reasons why boat insurance is a smart idea.

Boat insurance can provide coverage for:

- Damage to your boat including hull, sails, equipment, and more.

- New boat replacement

- Fuel spill liability

- Liability to pay for damages and injuries you cause if you hit another boat, person, dock

- Medical coverage for you and persons in your boat.

- Wreckage removal

What types of watercraft are covered by boat insurance?

All boats aren't the same. You need to customize your boat insurance to meet your needs and provide your watercraft with the proper coverage. Here is a list of the most common types of watercrafts.

- Pontoon boats are one of the most popular inland water boats. They are a flattish boats that rely on floats to remain buoyant. Their wide and spacious area is great for many passengers to enjoy the ride.

- Personal watercraft (PWC) are powered by a water jet pump and the rider generally sits, stands, or kneels on it. There are many types of PWCs which include WaveRunners, Sea-Doos and more.

- Fishing and bass boats are designed and equipped for fishing. Most are powered by an outboard motor and are equipped with power poles, trolling motors, etc.

- Powerboats are the most popular type of boat used for cruising, watersports, and so much more.

- Sailboats are propelled partly or entirely by sails.

If you don't see your watercraft listed and are looking for more information on different types of boats and insurance for boats, check out our boat FAQ page .

What does boat insurance cover?

A policy insures your boat against damage and loss caused by common risks, such as collision, fire, storms, and theft. Boat insurance may also help protect you if you accidently injure someone or damage their property with your boat.

Service and Claims

When you choose GEICO Boat Insurance, you have access to:

- Licensed agents as passionate about boating as you are

- Specialized service including 24/7 claims handling and towing

- Experience you can rely on

24/7 Boat Towing*

GEICO Marine Insurance Company has teamed with TowBoatUS, the nation's largest towing fleet to provide:

- 24/7 boat towing assistance

- On the water towing services provided by TowBoatUS

- Fuel delivery services

- Digital dispatch through the BoatUS app and more

Personal Watercraft (PWC) Insurance Coverage

You can get a boat policy for your PWC. Typical PWC insurance coverage includes:

- Damage to another craft or dock

- Physical damage to your watercraft

- Towing assistance

How much does boat insurance cost?

Boat insurance is based on the type of boat, length, number of engines and horsepower, how you use it (recreation, commercial charter, racing, etc.), and how and where it will be stored. All of these factors, including the experience and claims record of the owner will factor into the cost of boat insurance.

You could save even more with these boat insurance discounts.

We know discounts and our watercraft insurance agents can help you get them to help you save on your boat insurance quote.

Multi-Policy Discounts

If you're a current GEICO Auto Insurance policyholder, you could save on your boat insurance .

Boat Safety Courses

We know that safety comes first when you're having fun on the water. When you pass boat safety courses, you could save money on your boat insurance. Haven't taken one yet? Check out available courses from the BoatUs Foundation Site.

Need to speak with a boat insurance sales representative?

You can reach us at (855) 395-1412

- Mon - Fri 8:00 AM - 10:00 PM (ET)

- Sat - Sun 8:00 AM - 9:15 PM (ET)

Boat Insurance: Get the answers you're looking for.

- Is boat insurance required? Boat insurance liability coverage is only mandated in a few states, so always check insurance requirements for the state you're boating in. Physical damage coverage is required by your lender if you're financing your boat or watercraft. If you keep your boat at a marina, the marina may require you to have liability coverage.

- Liability to pay for damages and injuries you cause if you accidentally hit another boat, person, or dock

There are some types of watercraft that can't be added to a new or existing GEICO boat policy:

- Airboats, amphibious land boats or hovercraft

- Boat with more than 4 owners

- Boats over 50 feet in length

- Boats over 40 years old

- Boats valued over $2,500,000

- Floating homes

- Homemade boats

- Houseboats that do not have motors

- Steel hulls

- Wooden hulls

- Watercraft previously deemed a constructive total loss

- Does boat insurance cover theft? Our Ageed Hull Value, and Actual Cash Value policies protect against damage to your watercraft from incidents out of your control, including theft.

- How do I make a payment or manage my boat insurance policy? Managing your boat insurance policy and making payments is easy in the BoatUS app. You can also manage your policy or make payments online , or by calling (800) 283-2883 .

- How do I report a claim on my boat insurance policy? You can report your claim through the BoatUS app. Claims can also be reported online , or by calling (800) 937-1937 .

GEICO has teamed up with its subsidiary, BoatUS, to bring boaters a policy developed by specialists, with the great service you expect from GEICO. Policies are underwritten by GEICO Marine Insurance Company. BoatUS—Boat Owner's Association of The United States—is the nation's largest association for recreational boaters providing service, savings and representation for over 50 years.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Some discounts, coverages, payment plans, and features are not available for all customers, in all states, or in all locations.

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

Due to inclement weather conditions our office will be closed the morning of January 29th 2019

Hurricane michael claims.

- Get a Quote

- The Boating Specialists

- Find Out More

- Boston Whaler

- Boater's Choice Blog

- Learn How to Boat

- Why Boater's Choice

- Become a Dealer

- Get a Customer Quote

- Customer Service

Relax With The Right Protection

- Boater Liability Coverage up to 1,000,000 Dollars

- Agreed Value Paid on Total Loss, No Depreciation

- All Risk Physical Damage Insurance *

- Broad Navigation Area Allowances

- Year-Round Boat Protection

- Medical Payments Coverage

- Plus Lots More

We use cookies on this site to enhance your user experience.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products, hundreds of discounts, a free second membership, and a subscription to AARP the Magazine. Find how much you can save in a year with a membership. Learn more.

- right_container

Work & Jobs

Social Security

AARP en Español

Membership & Benefits

- Members Edition

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

AARP Hearing Center

Advice on Tinnitus and Hearing Loss

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach Vacation Ideas

Fun Beach Vacations

Road Trips For Every Personality

Passport Access

Passports Can Be Renewed Online

AARP National Park Guide

Black Canyon of the Gunnison

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

Movies for Grownups

Summer Movie Preview

Jon Bon Jovi’s Long Journey Back

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Friends & Family

How to Host a Fabulous Dessert Party

Home Technology

Caregiver’s Guide to Smart Home Tech

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Solves 25 of Your Problems

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Clean Your Car

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

See a full list of benefits and explore all that AARP membership offers.

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

AARP Long-Term Care Options from New York Life

Custom long-term care options to fit your needs and budget

AARP® Vision Plans from VSP™

Vision insurance plans designed for members and their families

AARP Term Life Insurance From New York Life

Coverage up to $150,000 that ends at age 80

AARP Permanent Life Insurance from New York Life

Up to $50,000 in coverage with no premium increases

AARP Guaranteed Acceptance Life Insurance from New York Life

Up to $25,000 in coverage with no premium increases

AARP Life Insurance Options from New York Life

Customized plans to supplement your retirement savings

Medicare Eligible

AARP® Medicare Supplement from UnitedHealthcare®

Medicare Supplement plans

AARP® Medicare Advantage from UnitedHealthcare®

Medicare Advantage plans

AARP Medicare Enrollment℠ Guide

Medicare information tailored to you

AARP Medicare Resource Center

Helpful resources to manage your current Medicare situation

AARP® Medicare Rx Plans from UnitedHealthcare®

Medicare Part D plans

Fetch Pet Insurance

10% off monthly premiums

Vehicle and Property

AARP® Auto Insurance Program from The Hartford

$577 average member savings

AARP® Homeowners Insurance Program from The Hartford

Up to 20% off when you bundle your home and auto policies

AARP® Mobile Home Insurance Program from Foremost®

Insurance for nearly every type of mobile and manufactured home

AARP® Motorcycle Insurance Program from Foremost®

Discounts on coverage, roadside assistance and more

Allstate Roadside

Roadside protection starting at $5.50/month

ATV, Golf Cart & Snowmobile Insurance from The Hartford

Customized coverage for recreation vehicles

Boat & Personal Watercraft Insurance from The Hartford

Customized coverage for your boat or watercraft

Collectible Vehicle Insurance from The Hartford

Coverage designed specifically for classic and collectible cars

Recreational Vehicle Insurance from The Hartford

Specialized protection for your RV, motorhome or trailer

Renters Insurance from The Hartford

Coverage for those renting an apartment, condo or house

Secure Your Family’s Future With Access to AARP Insurance Benefits

Explore a range of coverage options tailored for AARP members. Enjoy access to insurance products from top companies and personalized coverage for all your family’s needs. AARP is here to help provide you with peace of mind and protection. Explore insurance benefits and request a quote today.

Thai association cautions on insurance coverage for EVs

Tokio Marine Safety Insurance temporarily suspended standard premiums.

The Thai General Insurance Association (TGIA) cautioned member insurers regarding the burgeoning electric vehicle (EV) market in the country, as reported by the Bangkok Post .

EVs pose potential challenges as some insurance companies hesitate to provide coverage, cautioned the Thai Automotive Industry Association (TAIA).

Tokio Marine Safety Insurance recently announced a temporary suspension of its standard EV insurance premiums, opting to assess new rates on a case-by-case basis.

The move comes amid concerns over wide price fluctuations and high claim values associated with EVs.

Insurers, grappling with significant repair costs, particularly for EV battery packs, are reevaluating their coverage strategies.

In some cases, even minor damage to an EV's battery pack necessitates full replacement, which can account for a substantial portion of the vehicle's value.

Whilst Tokio Marine clarified that existing customers can renew policies based on their claims history, concerns remain within the industry.

The TGIA highlighted the higher costs of EV spare parts and emphasised the complexity insurers face in setting competitive premiums.

Despite these challenges, Thailand's EV market is expanding, with many vehicles imported from China and plans for local production and export.

The TAIA is engaging with global EV manufacturers and the TGIA to address insurance concerns and ensure the market's sustainable growth.

Meanwhile, insurers are adjusting their EV insurance criteria, including premiums and battery claim conditions, effective from June.

This evolving landscape necessitates corresponding adjustments in auto loan practices, with considerations for higher collateral requirements and revised insurance conditions for EVs.

Financial Reporting and Analysis Software

- Our products:

- Financial Analysis

- Reporting Tool

- US Industry Benchmarking

- Russian Entites Profiles

Russian Company MSZ JSC

Brief profile.

active Commercial

| TIN | 5053005918 |

| Region, city | Moscow Oblast, Elektrostal |

| Company Age | (for comparison: the industry average is 20 years) |

| Core Activity | Processing of nuclear fuel |

| Scale of Operation | |

| Founder | Registrar: (100%; 1.7 billion RUB) |

| Manager | (general manager) |

| Where the company is listed as the founder | (97.44%; 38 million RUB) (49%; 4.9 thousand RUB) |

Facts to Consider

4 more firms are registered at the address of the organization.

The organization is the founder (co-founder) of a mass media

The organization holds 16 licenses.

show 2 more positive facts

Complete Profile

- 1. General Information

- 2. Registration in the Russian Federation

- 3. Company's Activities

- 4. Legal Address

- 5. Owners, Founders of the Entity

- 6. MSZ JSC CEO

- 7. Entities Founded by Company

- 8. Company Finance

- 9. Entities related to MSZ JSC

- 10. Timeline of key events

- 11. Latest Changes in the Unified State Register of Legal Entities (USRLE)

General Information

Full name of the organization: MSZ MACHINERY MANUFACTURING PLANT, JOINT-STOCK COMPANY

TIN: 5053005918

KPP: 505301001

PSRN: 1025007111491

Location: 144001, Moscow Oblast, Elektrostal, ul. Karla Marksa, 12

Line of business: Processing of nuclear fuel (OKVED code 24.46)

Organization status: Commercial, active

Form of incorporation: Non-public joint-stock companies (code 12267 according to OKOPF)

Registration in the Russian Federation

The tax authority where the legal entity is registered: Mezhraionnaia inspektsiia Federalnoi nalogovoi sluzhby №6 po Moskovskoi oblasti (inspection code – 5031). The tax authority before 08/23/2021 – Inspektsiia Federalnoi nalogovoi sluzhby po g. Elektrostali Moskovskoi oblasti (code 5053).

Registration with the Pension Fund: registration number 060055000355 dated 19 December 1991.

Registration with the Social Insurance Fund: registration number 501900175750191 dated 22 November 2000.

Company's Activities

The main activity of the organization is Processing of nuclear fuel (OKVED code 24.46).

Additionally, the organization listed the following activities:

| 24.20 | Manufacture of steel pipes, hollow profiles and fittings |

| 24.45 | Other non-ferrous metal production |

| 25.50 | Forging, pressing, stamping and profiling, manufacturing of products by powder metallurgy |

| 25.62 | Machining of metal products |

| 33.12 | Repair of machinery and equipment |

The organization is included in the Roskomnadzor registry of registered mass media as a founder (co-founder) of the following media:

| Energiia | PI № TU 50 - 1185 | valid | print media newspaper | Moscow oblast | 144001, Moskovskaia obl., g. Elektrostal, ul. Karla Marksa, d. 9, ofis 212 |

| Elemash-TV | EL № FS 1 - 50929 | terminated | TV program | Moscow oblast | 144009, Moskovskaia obl., g. Elektrostal, ul. Karla Marksa, d. 12 |

MSZ JSC holds licenses entitling to carry out the following activities:

| Number, date of issue | Issued by | Types of operations | Valid |

|---|---|---|---|

| GN-10-115-4505 of 09/15/2023 | FEDERAL SERVICE FOR ENVIRONMENTAL, TECHNOLOGICAL AND NUCLEAR SUPERVISION | Design and construction of nuclear installations, radiation sources, storage facilities for nuclear materials and radioactive substances, storage facilities for radioactive waste | from 09/15/2023 |

| GN-11-101-4473 of 07/05/2023 | FEDERAL SERVICE FOR ENVIRONMENTAL, TECHNOLOGICAL AND NUCLEAR SUPERVISION | Design and manufacture of equipment for nuclear installations, radiation sources, storage facilities for nuclear materials and radioactive substances, storage facilities for radioactive waste | from 07/05/2023 |

| L007-00102-77/00654451 of 06/01/2023 | MINISTRY OF INDUSTRY AND TRADE OF THE RUSSIAN FEDERATION | Development, production, testing and repair of aviation equipment, with the exception of unmanned aircraft systems and (or) their elements, including unmanned civil aircraft with a maximum take-off weight of 30 kilograms or less | from 06/01/2023 |

The organization is included in the Roskomnadzor registry as a personal data processing operator .

Legal Address

MSZ JSC is registered at 144001, Moscow Oblast, Elektrostal, ul. Karla Marksa, 12. ( show on a map )

The following organization are also registered at the following address (including liquidated organizations):

- CENTRAL DESIGN AND TECHNOLOGICAL INSTITUTE JSC

The reason may be that the address’s accuracy wasn’t ascertained after the registration. Otherwise the address can be recognized as an address of mass legal entities registration.

Owners, Founders of the Entity

The list of organization’s shareholders is kept at registrar AO "NRK-R.O.S.T." .

According to the Unified State Register of Legal Entities (USRLE) the organization’s founder is (can be inconsistent with the current shareholders composition – the relevant details are available at the registrar only):

| Founder | Share | Nominal value | from which date |

|---|---|---|---|

| (Moscow) | 100% | 1.7 billion RUB | 05/12/2022 |

Subject to the entire chain of the current founders, the list of MSZ JSC ultimate founders is as follows:

| Ultimate founders | Share | Nominal value | Via |

|---|---|---|---|

| 100% | 1.7 billion RUB |

MSZ JSC CEO

The head of the organization (a person who has the right to act on behalf of a legal entity without a power of attorney) since 10 August 2021 is general manager Bagdatev Dmitrii Nikolaevich (TIN: 505304128446).

- (general manager from 07/08/2019 until 08/10/2021 * )

- (general manager from 01/25/2011 until 07/10/2019 * )

Entities Founded by Company

Currently MSZ JSC is listed as a founder in the following organizations:

- OOO "MSZ-M" (Moscow Oblast, Elektrostal; 97.44%; 38 million RUB)

- OOO UNTS "NUKLON" PRI MGTU IM. N.E.BAUMANA (Moscow; 49%; 4.9 thousand RUB)

Previously the organization was listed as a founder in:

- ANO "KSK "KRISTALL" (Moscow Oblast, Elektrostal) - until 12/15/2021

- 1-I NPF AO (Moscow; 0.34%; 1.2 million RUB) - until 12/31/2021

- TOR "SOVET PROMYSHLENNIKOV I PREDPRINIMATELEI GORODSKOGO OKRUGA ELEKTROSTAL MOSKOVSKOI OBLASTI" (Moscow Oblast, Elektrostal) - until 12/15/2021

- AO "TVEL-STROI" (Moscow; 1.7 million RUB) - until 10/04/2021

- TSZH "ELEMASH-VOSTOK" (Moscow Oblast, Elektrostal) - until 01/01/2022

Company Finance

The Authorized capital of MSZ JSC is 1.7 billion RUB.

Until 05/25/2020 the authorized capital was 1.7 billion RUB., before 02/14/2019 – 1.6 billion RUB, before 02/13/2018 – 1.6 billion RUB

The net assets of MSZ JSC as of 12/31/2021 totaled 57.2 billion RUB.

The MSZ JSC’s operation in 2021 resulted in the profit of 1.7 billion RUB. This is by 26.6 % less than in 2020. Please note that the financial performance is given for 2021; no data available for 2023.

The organization is not subject to special taxation regimes (operates under a common regime).

The organization had no tax arrears as of 05/10/2024.

Entities related to MSZ JSC

Based on the data from the Unified State Register of Legal Entities, the following legal entities and people are directly or indirectly related to the organization.

| People and organizations directly related to MSZ JSC | People and organizations indirectly related to MSZ JSC | |

|---|---|---|

| through the entities listed in column 1 | through the entities listed in column 2 | |

| 1 | 2 | 3 |

| ( - founder) ( - founder) ( - founder until 12/15/2021 ) ( - founder until 12/31/2021 ) ( - founder until 12/15/2021 ) (general manager) (founder) (general manager until 08/10/2021 ) (general manager until 07/10/2019 ) | (founder of ; - founder) ( - founder until 09/22/2021 ; is located at the same address as ) (director of ) (director of ) (founder of ) ( - founder) ( - founder) ( - founder) ( - founder) ( - founder) show 24 more affiliates of TVEL JSC (the president of ) (founder of ) (director of ) (representative of the bankruptcy trustee of ) (chairman of the association of ) (general manager of ) (chairman of the management board of ) (accountant of ) (the chairman of ) (founder of until 12/31/2021 ) (founder of until 12/31/2021 ) (founder of until 12/15/2021 ) (founder of until 12/15/2021 ) ( - founder until 12/15/2021 ) (founder of until 10/04/2021 ) (founder of until 10/04/2021 ) ( - founder until 01/02/2022 ; founder of until 10/04/2021 ) (liquidated 02/18/2019) ( - founder; was at the same address as ) (is located at the same address as ) (is located at the same address as ) (was at the same address as ) (director of until 11/16/2020 ) (founder of until 05/04/2021 ) (director of until 07/13/2022 ) (representative of the bankruptcy trustee of until 04/29/2021 ) (founder of until 12/31/2021 ) (founder of until 12/31/2021 ) (liquidated 12/28/2015) ( - founder until 01/03/2022 ) (liquidated 09/14/2015) ( - founder until 01/03/2022 ) (founder of until 01/01/2022 ) (liquidated 03/16/2011) ( - founder) | (general manager of ) (general manager of ) ( - founder) ( - founder) ( - founder) ( - founder) ( - founder) show 67 more affiliates of MGTU IM. N.E. BAUMANA (liquidated 11/13/2023) ( - legal successor; - founder until 01/01/2022 ) (liquidated 09/18/2009) ( - founder until 01/02/2022 , legal successor) (liquidated 07/20/2009) ( - founder until 01/02/2022 , legal successor) (liquidated 05/06/2009) ( - founder until 01/02/2022 , legal successor) (liquidated 08/05/2009) ( - founder until 01/02/2022 , legal successor) (liquidated 03/05/2009) ( - founder until 01/02/2022 , legal successor) |

Timeline of key events

Latest changes in the unified state register of legal entities (usrle).

- 06/24/2024 . Submission of information about the registration of an individual at the place of residence.

- 05/25/2024 . Representation by the licensing authority of information about the grant of a license.

- 11/18/2023 . Representation by the licensing authority of information about the grant of a license.

- 09/07/2023 . State registration of changes made to the constituent documents of a legal entity related to changes in information about a legal entity contained in the Unified State Register of Legal Entities, based on an application.

- 06/13/2023 . Representation by the licensing authority of information about the grant of a license.

- 06/02/2023 . Representation by the licensing authority of information about the grant of a license.

- 05/12/2022 . Change of information about a legal entity contained in the Unified State Register of Legal Entities.

- 03/25/2022 . State registration of changes made to the constituent documents of a legal entity related to changes in information about a legal entity contained in the Unified State Register of Legal Entities, based on an application.

- 10/18/2021 . Submission by the licensing authority of information on the renewal of documents confirming the existence of a license (information on the renewal of a license).

- 10/01/2021 . Submission by the licensing authority of information on the renewal of documents confirming the existence of a license (information on the renewal of a license).

* The date of change in the Unified State Register of Legal Entities is shown (may be different from the actual date).

The data presented on this page have been obtained from official sources: the Unified State Register of Legal Entities (USRLE), the State Information Resource for Financial Statements, the website of the Federal Tax Service (FTS), the Ministry of Finance and the Federal State Statistics Service.

Start free Ready Ratios financial analysis now!

No registration required! But once registered , additional features are available.

- Terms of Use

- Privacy Policy

The Unique Burial of a Child of Early Scythian Time at the Cemetery of Saryg-Bulun (Tuva)

<< Previous page

Pages: 379-406

In 1988, the Tuvan Archaeological Expedition (led by M. E. Kilunovskaya and V. A. Semenov) discovered a unique burial of the early Iron Age at Saryg-Bulun in Central Tuva. There are two burial mounds of the Aldy-Bel culture dated by 7th century BC. Within the barrows, which adjoined one another, forming a figure-of-eight, there were discovered 7 burials, from which a representative collection of artifacts was recovered. Burial 5 was the most unique, it was found in a coffin made of a larch trunk, with a tightly closed lid. Due to the preservative properties of larch and lack of air access, the coffin contained a well-preserved mummy of a child with an accompanying set of grave goods. The interred individual retained the skin on his face and had a leather headdress painted with red pigment and a coat, sewn from jerboa fur. The coat was belted with a leather belt with bronze ornaments and buckles. Besides that, a leather quiver with arrows with the shafts decorated with painted ornaments, fully preserved battle pick and a bow were buried in the coffin. Unexpectedly, the full-genomic analysis, showed that the individual was female. This fact opens a new aspect in the study of the social history of the Scythian society and perhaps brings us back to the myth of the Amazons, discussed by Herodotus. Of course, this discovery is unique in its preservation for the Scythian culture of Tuva and requires careful study and conservation.

Keywords: Tuva, Early Iron Age, early Scythian period, Aldy-Bel culture, barrow, burial in the coffin, mummy, full genome sequencing, aDNA

Information about authors: Marina Kilunovskaya (Saint Petersburg, Russian Federation). Candidate of Historical Sciences. Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Vladimir Semenov (Saint Petersburg, Russian Federation). Candidate of Historical Sciences. Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Varvara Busova (Moscow, Russian Federation). (Saint Petersburg, Russian Federation). Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Kharis Mustafin (Moscow, Russian Federation). Candidate of Technical Sciences. Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected] Irina Alborova (Moscow, Russian Federation). Candidate of Biological Sciences. Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected] Alina Matzvai (Moscow, Russian Federation). Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected]

Shopping Cart Items: 0 Cart Total: 0,00 € place your order

Price pdf version

student - 2,75 € individual - 3,00 € institutional - 7,00 €

Copyright В© 1999-2022. Stratum Publishing House

Politics latest: Cameron resigns as Sunak names shadow cabinet; Labour MPs assemble for group photo

Sir Keir Starmer has assembled his Labour MPs for a huge group photo in Westminster after the party's landslide election win. Meanwhile, Rishi Sunak has reshuffled his top team as the Tories prepare for opposition.

Monday 8 July 2024 20:30, UK

- General Election 2024

Please use Chrome browser for a more accessible video player

- Sunak names shadow cabinet

- Sam Coates analysis: Low-energy Tory reshuffle has one eye-catching move

- Labour MPs assemble for huge group photo

- Reeves outlines plan to boost housebuilding and reform planning

- Ed Conway analysis: No big bang moment from chancellor, but hard reforms could one day deliver what UK's long struggled with

- Live reporting by Faith Ridler

Election fallout

- Starmer's challenges: Tackling exhausted NHS | Looming chaos abroad | Defence to dominate early days | Small boats plan? | Rift with scientists needs healing

- Read more from Sky News: What to expect from Labour's first 100 days | Who's who in Starmer's inner circle | A look back at life when Labour last won power | Find our other must-read election features

- Results in full: What happened in every constituency

With the change of government, the Conservatives' controversial Rwanda migration scheme has been scrapped.

Rishi Sunak had pledged to get planes carrying asylum seekers off the tarmac by the spring, and then shifted his target date to July should he have won the general election.

Sir Keir Starmer is now in the top job, and has stressed the Rwanda scheme was "dead" on day one of his government.

We've now heard from the Rwandan government, which has reiterated it "upheld its side of the agreement, including with regard to finances".

Kigali said it "takes note" of the UK government's intention to "terminate" the agreement.

It added: "This partnership was initiated by the government of the UK in order to address the crisis of irregular migration affecting the UK — a problem of the UK, not Rwanda.

"Rwanda has fully upheld its side of the agreement, including with regard to finances, and remains committed to finding solutions to the global migration crisis, including providing safety, dignity, and opportunity to refugees and migrants who come to our country."

Sir Keir Starmer heads to Washington for a NATO summit tomorrow, and we've just had confirmation his visit will include face-to-face talks with US President Joe Biden.

The White House said Mr Biden would host the new prime minister on Wednesday.

It comes after the pair spoke on the phone on Friday evening - a clip of which was released by Number 10.

We'll continue to have updates through the night right here.

And you can scroll down the page for all the latest from the Politics Hub.

Sam Coates , our deputy political editor, has given his thoughts on the Tory shadow cabinet reshuffle which just took place (see 19.12 post).

He says it appears to come from a place of "low energy" from Rishi Sunak, who has confirmed he will shortly resign as leader.

Sam adds: "I certainly think the Tories are going to spend some time struggling to adjust to a new political tempo.

"That's what this reshuffle Rishi Sunak has just done this evening says.

"Looking at some of the heavyweights backing out like Lord Cameron, you do wonder just how much some of them are up for the fight."

But the appointment of Kemi Badenoch is one to watch.

She is now shadowing deputy prime minister Angela Rayner on the levelling-up brief - moving from business.

"That looks like a promotion - it puts her up against one of the biggest figures in the government," Sam says.

"It's the reshuffle that Rishi Sunak has essentially had to do because he has so few cards to play," he adds, as the former PM only has 121 MPs to choose from.

Peter Kyle, the science and technology secretary, is then asked if Labour has started a war on the NIMBY - which stands for "not in my backyard".

Chancellor Rachel Reeves today promised to get Britain building, with more houses and wind farms on Labour's agenda - and asking councils to review greenbelt land.

Mr Kyle says this is simply central government "using its power assertively, but respectfully, to get things moving".

"We made pledges in the election campaign and already today you're seeing them being honoured," he says.

He adds Labour wants to ensure the UK is breaking down "barriers to investment, not putting them up" as he says the previous government did.

Government an 'assertive partner' for local authorities

He disputes the suggestion central and local government "are in conflict".

"What we want to do is make sure that these are partnerships," he adds.

"There are some local authorities who want to build things but have been prevented from doing so - including onshore windfarms."

Mr Kyle says Labour will lift this block, saying the government will be an "assertive partner" helping to "get things done".

He is then asked specifically if the government would overrule local interests.

"There are powers that central government has that other parts of government don't have - and we will use those powers when it is in the national interest."

Peter Kyle, the new science and technology secretary, is now joining Sophy Ridge on the Politics Hub.

She asks if the election win - and his appointment - have sunk in yet.

Mr Kyle says it "has sunk in" in the sense "we're so deep already" - working through the weekend on a "programme for government" and "making sure we can get the right things cracking from day one".

On the other hand, he admits he "wakes up every morning thinking the previous day was a dream".

'Loving every second'

"It was just so special and so remarkable," Mr Kyle adds.

"The privilege we've been given, and I've been given, by the public and by the prime minister, is something that I take incredibly seriously.

"I am loving every second."

Rishi Sunak has announced his Conservative shadow cabinet - the first the party's had for more than 14 years.

Most of the former cabinet shadow their old roles - like James Cleverly being shadow home secretary, and Jeremy Hunt as shadow chancellor.

But there's no Lord Cameron - instead Andrew Mitchell has been appointed shadow foreign secretary.

He had been the deputy foreign secretary in the last parliament.

Richard Holden is also out as the party chairman.

And Kemi Badenoch has been moved from the business brief, instead shadowing Angela Rayner on housing and levelling up.

But it isn't clear how long these appointments will be in place, as Rishi Sunak confirmed last Friday that he will shortly resign.

The process for appointing a new Tory leader will be decided by the executive of the 1922 Committee, assisted by CCHQ.

A new chair will be elected as soon as this week, our chief political correspondent Jon Craig says.

Our economics and data editor Ed Conway is giving Sophy his view on the chancellor's speech - and one word comes to mind: boring.

He says: "It one sense it was desperately boring because the topic it covers, planning, is boring and perhaps it was intentionally boring.

"I was thinking back to 1997 when Gordon Brown, straight after the election, in that same room, announced that the Bank of England was going to be made independent.

"That was his 'big bang' moment."

However, Ed says that, this time around there is no space for this.

"This time around, I think there's an acknowledgement that it's not like you can do 'big bang' things - you need to do this kind of hard work, of execution and making things happen," he says.

"And planning is the ultimate example of that, you don't just press a button and sort it out."

Watch Ed's full analysis below:

Well, they're not hanging about, are they?

A full cabinet, a flurry of policy announcements, a speech from the chancellor and a tour of all four nations by the prime minister.

No time to sit in a dark room, pour a stiff drink and recover after the general election campaign.

And to be honest, you can see why. The incoming Labour government has built almost their entire economic strategy around one thing: growth.

If you ask them how they can possibly improve public services without putting up taxes or breaking their fiscal rules, this is the answer they give.

No growth? Big problem

The problem is it's quite hard to get growth. You can't just click your fingers and it comes.

And it's unpredictable - you can do all the right things, but a big international event, or a national crisis, changes everything.

So you can see why Labour aren't hanging around. Today, Rachel Reeves is pulling out all the stops to try to get growth back into the economy.

She's bringing back housebuilding targets, overhauling the planning system, and ending the ban on onshore wind farms.

And Labour need it to work. Without growth, they've got a big hole in their economic plans.

Our weeknight politics show Politics Hub With Sophy Ridge is live now on Sky News.

The fast-paced programme dissects the inner workings of Westminster, with interviews, insights, and analysis - bringing you, the audience, into the corridors of power.

Sophy is joined tonight by Peter Kyle , the new science and technology secretary.

On Sophy's panel tonight are:

- Jim Murphy , former Scottish Labour leader;

- Baroness Sayeeda Warsi , Conservative peer and former minister.

Watch live on Sky News, in the stream at the top of this page, and follow live updates here in the Politics Hub.

Watch Politics Hub With Sophy Ridge from Monday to Thursday on Sky channel 501, Virgin channel 602, Freeview channel 233, on the Sky News website and app or on YouTube .

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

COMMENTS

Chubb offers Masterpiece® Yacht and Masterpiece Yacht Preference policies for private, pleasure yachts 36 feet or greater in length. Enjoy agreed value coverage, liability protection, replacement cost settlement, uninsured/underinsured boater coverage, and more.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances. Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000.

Liability coverage in your boat insurance can help protect you if you cause injury to others or damage their property while using your boat. Medical payment s coverage provides reimbursement for injuries to you and your guests. Boat or yacht insurance even covers on-water towing.

Boat and yacht insurance coverage More inclusive basic boat insurance coverage. Get basic boat insurance coverage with protection for which other carriers may require additional premiums such as mechanical breakdown, uninsured boater, personal property, medical payments, commercial towing reimbursement, fuel spills and dinghy coverage.

Yacht Insurance: An insurance policy that provides indemnity liability coverage on pleasure boats. Yacht insurance includes liability for bodily injury or damage to the property of others and ...

Much like car and home insurance, yacht insurance is an insurance policy that provides liability coverage on high-end pleasure boats. This policy typically provides liability for bodily injury or damage to the property of others and damage to personal property aboard the vessel. Yacht insurance is provided for vessels considered to be 27 feet ...

Boat insurance costs approximately 1.5% of the boat's total value annually. For example, a boat worth $20,000 would cost roughly $300/year to insure, while a yacht worth $200,000 could be more like $3,000 to insure. According to a MarketWatch report published in December 2022, the average cost of boat insurance last year ranged from $200 to $500.

Boat Insurance. We offer some of the most seaworthy coverage and services available. Our Masterpiece Boat and Masterpiece Boat Select policies are designed for all types of pleasure boats 35 feet and less, as well as Personal Watercraft (PWCs) vessels like waverunners and jet skis. We provide exceptional boat insurance with tailored protection ...

If you enjoy activities like fishing while using your yacht, we can customize coverage to fit your lifestyle including fishing equipment protection, trip coverage, boat house, lift and trailer coverage and much more. Have questions? We are here to help. 800-762-2628. [email protected].

Because yachts inherently incur more risk due to their size and navigation, the liability feature of yacht insurance provides broad coverage designed to shield you from the effects of the maritime law. Your coverage is much broader than with a typical watercraft liability policy, and offers protection to permissive users, captain and crew ...

Find a Markel marine agent and get a free, no-obligation quote today. If you love your yacht, you'll love our insurance. We've been the yacht insurance leader for over 45 years because we provide coverages that fit your yacht and your lifestyle. Markel yacht insurance can offer distinct advantages in coverage features, options, knowledge ...

Arkansas residents must purchase a boat insurance policy that includes at least $50,000 in liability coverage per incident. Utah residents can choose between one of two liability coverage options ...

Yacht insurance, also known as boat insurance, is a type of insurance that provides coverage for yachts or boats against potential risks or damages. Yacht insurance policies can protect yacht owners from financial losses associated with accidents, damage, theft, liability claims, and other unforeseen events that can occur while the yacht is in ...

Boat & Yacht Insurance. From small boats to large yachts, it's smooth sailing with Chubb. Whether you own a runabout, sailboat, yacht or mega-yacht with a full-time captain and crew, we offer some of the most comprehensive coverage and services available. ... Coverage is available for pleasure yachts 36 feet or greater in length and up to $3 ...

Boat insurance can provide coverage for: Damage to your boat including hull, sails, equipment, and more. New boat replacement; Fuel spill liability; Liability to pay for damages and injuries you cause if you hit another boat, person, dock; Medical coverage for you and persons in your boat. Wreckage removal

Boat insurance is widely available. NerdWallet looked at the top 25 auto insurance sellers in the country and found these that also offer boat insurance: AAA. Offers coverage for boats up to ...

Here are just a few coverage highlights: Boater Liability Coverage up to 1,000,000 Dollars. Agreed Value Paid on Total Loss, No Depreciation. All Risk Physical Damage Insurance *. Broad Navigation Area Allowances. Year-Round Boat Protection. Medical Payments Coverage. Plus Lots More. * subject to policy exclusions.

With over 45 years of marine insurance experience, Markel provides a level of expertise that is unsurpassed in the marine industry. Plus, unlike a typical homeowners insurance policy, we focus on marine insurance and have developed a wide variety of marine insurance coverage for almost any type of boat or watercraft.

Purchase coverage online or by phone. Boat Insurance Quotes on your screen in 90 seconds. United Marine Underwriters Toggle navigation (800) 477-7140 (502) 222-0199 Get Quote smsText United Marine Underwriters (800) 477-7140. United Marine Underwriters (800) 477-7140 ...

Boat liability coverage helps protect you from covered claims and lawsuits including payment of settlements and legal fees. Consider your needs and possible risks so that you purchase the best liability coverage for you and your boat. Other coverage. Your insurer may offer additional kinds of coverage to go with your basic boat insurance.

Explore a range of coverage options tailored for AARP members. Enjoy access to insurance products from top companies and personalized coverage for all your family's needs. AARP is here to help provide you with peace of mind and protection. Explore insurance benefits and request a quote today.